- Joined

- 13 February 2006

- Posts

- 5,400

- Reactions

- 12,570

Professor the only downside to Rio is the SP.Rio Tinto (ASX:RIO) on My Investment Radar

I've recently been researching Rio Tinto Group (ASX:RIO) as a potential addition to my 5-position investment portfolio when excess funds become available. I find it to be a compelling investment candidate for several reasons.

1. Dividend Attractiveness

Rio Tinto currently offers an appealing dividend yield of 4.50% with 100% franking. This makes it a strong choice for like-minded investors who prioritise steady income streams.

2. Strategic Positioning

With a diverse portfolio of world-class assets, including iron ore, aluminium, and copper, Rio Tinto has established a robust foundation for enduring profitability. The company is well-equipped to navigate the evolving demands of the resources sector. Additionally, Rio Tinto has demonstrated resilience in volatile markets through its operational efficiency, which has consistently underpinned its market performance.

Summary

Overall, given its attractive dividend profile and strategic positioning in key commodities, Rio Tinto appears to be a solid investment candidate that aligns well with my investment portfolio. The company's diversification and operational resilience make it an appealing option to consider.

Skate.

Professor the only downside to Rio is the SP.

Personally, I prefer FMG, my love company.

It will be one that I will have on my July 1 paper portfolio.

With a 5-1 ratio the FMG dividend appeals to me.

i have held RIO in the past , i deserted it over the way it was handling the aluminum/bauxite assets AND potential cost increases in that arm in the future@farmerge, my current investment portfolio consists of ANZ, BHP, CBA, FMG, and Woodside Energy (WDS). I've been considering potential rotational candidates to replace WDS, but the reasons for holding Woodside Energy remain valid based on my previous analysis.

The hesitation I have with adding Rio Tinto Group (ASX:RIO) is the potential concentration risk, as I already hold positions in BHP and FMG, two other major mining companies. The question I've been grappling with is whether I need another exposure to the resources sector.

However, after further evaluation, I believe the case for including Rio Tinto in my portfolio is compelling. Rio Tinto is well-equipped to navigate the evolving demands of the resources sector and has built a strong foundation for enduring profitability. Furthermore, Rio Tinto's attractive dividend yield of 4.50% with 100% franking makes it a compelling option for income-oriented investors like myself.

Skate.

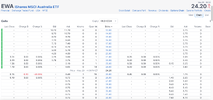

So this is the price that I will use for the paper trade.

View attachment 177768

I'll fill in details later.

jog on

duc

You ban Russia because the west doesn't like it and would lose medals, and Zelenski refuses Macron offer of a cease fire during the game, not sure Hamas and Israel are keen either.Professor, not too sure about peace and unity.

True but in the last year(less than), has any company left/been added to the specific realm used?You've forgotten to incorporate the changes in the index since 1 Jul 2023. Survivorship bias fail.

Ok just noted Richard de facto response ..I posted too earlyTrue but in the last year(less than), has any company left/been added to the specific realm used?

I do not think so, so there was no survivorship bias in that case

So now that I have some time:

If I were to open this position, I would SELL PUTS at the price that I wanted and wait to be exercised on them, thereby entering the position with an immediate return

Mr Skate can let me know if he is happy for that to happen.

For the moment the hypothetical $100K is split 60/40

60% is as a position.

So 2432 shares at $24.67

40% in cash to be deployed as and when.

I'll update once a week alongside Mr Skate's updates on his hypothetical positions.

I will be buying/selling over the period of the experiment. Dividend payments will be discretionary. Sometimes reinvested immediately at other times simply additive to the cash position.

jog on

duc

True but in the last year(less than), has any company left/been added to the specific realm used?

I do not think so, so there was no survivorship bias in that case

You've forgotten to incorporate the changes in the index since 1 Jul 2023. Survivorship bias fail. The following were changes in the S&P/ASX 20 since 1 July 2023: QBE Insurance (addition) - Newcrest Mining (takeover) - Newmont Corp (addition, removal)

I think you actually mean "I acknowledge the error but choose to ignore it"

You've effectively left out 1 takeover (with scrip-for-scrip rollover relief for CGT) and then a subsequent capital event. You've also got unfranked dividends in the mix plus (foreign) withholding tax too. It all gets ugly complicated quickly - spend the time to do it right - right now you're just doing a "throw 5 darts at the (inaccurate) top 20 strategy" versus "equal weighting of an inaccurate top 20"

@ducati916, providing an ongoing in-depth explanation of your trading decisions is a fantastic way to help everyone following along learn from your process. I greatly appreciate your transparent approach, where you share your actions and thoroughly explain the rationale behind them.

Your strategy of selling puts to enter positions sounds intriguing and could be quite educational. I'm particularly interested in learning more about how you determine the strike price at which you're willing to sell the puts. Could you walk us through your thought process on selecting the strike price based on the current market conditions? What factors do you consider when deciding on the appropriate strike level?

Additionally, I'd be very interested in understanding how you decide when it's the right time to deploy your cash reserve. Your insights on these decision-making processes would be incredibly valuable for us following your trading experiment. Sharing your thought process and the various considerations you take into account would be beneficial for us to learn from your approach.

Your willingness to share your trading journey in such detail is greatly appreciated. I believe the educational value of your explanations will be invaluable for those who read this thread, and I look forward to learning more about your put-selling strategy and cash deployment decisions.

Skate.

View attachment 177830View attachment 177829View attachment 177828

I will enter positions on the weekly chart.

On the weekly I would use the box and sell PUTS to the number of shares that I wanted in allocations of 100/contract.

In this case I would sell 24 contracts at whatever the price is. Last price was $0.58 (thin Options on this stock). So you would pocket $1392.00 while you waited to see if you were exercised. You do need to have the available cash in the account for this to be viable.

I will if filled, then calculate buy and sell points for my held stock.

In this exercise I have already taken a position at $24.67. I will trade at BUY $20.56 and SELL at $30.84 a % of my shares.

I have 40% cash held in reserve to buy. I am bearish on this stock currently. Hence the 40% cash. If I had been bullish, I may have only held 20% or 10% as cash.

jog on

duc

unlike the 'reverse index' ETFs GEAR should be a possible long term hold , if desired ( the 'reverse index ETFs are time sensitive )Love the action. I would do something different. I'd focus on a few ASX ETFs to beat the market. My ETF of choice is GEAR. This is a leveraged ETF that follows the market. The leverage is approx 2 and while this is good when the market goes up it's doubly bad when the market goes down. Buying and holding this ETF for longer terms would see many ups and pretty harsh downs. During the Covid selloff GEAR lost 70% of its value.

My aim is to not only beat the market but to do it without suffering a 15% drawdown. This means I'd have to time my entries into GEAR as I couldn't hold during a market selloff more than 7% when fully invested.

GEAR covers the broad ASX market but as I'm bullish a few commodities I would include a few commodity ETFs, GDX (gold producers), WIRE (copper producers), URNM (uranium producers) and let's not leave out tech, SEMI (semiconductors).

GEAR would be the main holding with the other ETFs at about 30% in total.

As I get more experience I realise that investors should take more advantage of the many market dips (and selloffs). I know it's hard to buy when everyone is selling but there's always a bottom. Every economic crisis will be overcome.

I would buy some GEAR in this dip. Not much, about 20% as an initial position. I'd wait for dips in the commodity markets before buying them. A stronger USD would create the dips I need.

Plenty of opportunities in the markets these days. We needn't feel restricted at all.

I have been there, and tried it!@ducati916, I must acknowledge that my trading experience has been predominantly centred around trading breakout strategies. The educational value will be immense by providing the thought processes behind strategic trading decisions.

The clarity with which you share your options trading strategies not only demystifies the complexities of the market but also serves as a practical guide for managing risk and optimising returns amidst market volatility.

Skate.

I display a Chart of the TLS for you inspection

View attachment 177759

I assume your lines are based on the Closing Price???????@Captain_Chaza, indeed, there are strategies for trading Telstra Corporation Limited (TLS), yet as you’ve hinted, the journey may be fraught with challenges. The stock market chart for TLS, featuring candlestick patterns and technical indicators like MACD and Parabolic SAR, suggests a complex trading landscape that requires careful navigation.

View attachment 177760

Skate.

Love the action. I would do something different. I'd focus on a few ASX ETFs to beat the market. My ETF of choice is GEAR. This is a leveraged ETF that follows the market. The leverage is approx 2 and while this is good when the market goes up it's doubly bad when the market goes down. Buying and holding this ETF for longer terms would see many ups and pretty harsh downs. During the Covid selloff GEAR lost 70% of its value.

My aim is to not only beat the market but to do it without suffering a 15% drawdown. This means I'd have to time my entries into GEAR as I couldn't hold during a market selloff more than 7% when fully invested.

GEAR covers the broad ASX market but as I'm bullish a few commodities I would include a few commodity ETFs, GDX (gold producers), WIRE (copper producers), URNM (uranium producers) and let's not leave out tech, SEMI (semiconductors).

GEAR would be the main holding with the other ETFs at about 30% in total.

As I get more experience I realise that investors should take more advantage of the many market dips (and selloffs). I know it's hard to buy when everyone is selling but there's always a bottom. Every economic crisis will be overcome.

I would buy some GEAR in this dip. Not much, about 20% as an initial position. I'd wait for dips in the commodity markets before buying them. A stronger USD would create the dips I need.

Plenty of opportunities in the markets these days. We needn't feel restricted at all.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.