- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

I assume your lines are based on the Closing Price???????

Unfortunately, The greatest moves the next day are in the opening prices (NB: the GAPS + and even Gaps - )

You only need to check your best ONE or TWO WINNERS to see if you were Gapped Out on the open

There might be something here BUT

IMHO The problem with FREE charting Software is that it only worth what you paid for it

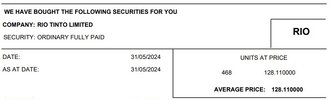

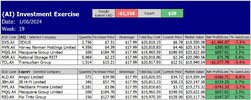

@Captain_Chaza, I only use the opening prices for my chart analysis on both the buy and sell side as I trade exclusively in the pre-auction. Regarding TradingView charting software, while it’s true that paid services often offer more features, free software can still be a useful tool for many traders, especially those just starting out or with limited resources.

Skate.