- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

Skate, you've done a bit of work using the MACD in your systems trading.

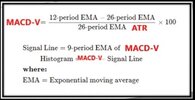

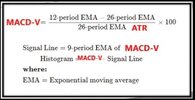

I want to mention some work done by Alex Spiroglou. He's developed an indicator based on the MACD called MACD-v (volatility normalised momentum). This indicator is unbounded and it's values can be compared across markets (stocks).

I think you may find this indicator more useful in your trading systems. Definitely worth some research.

Edit: Added formula from one of Alex's presentations.

View attachment 176632

@peter2, I appreciate your valuable contribution in sharing information about the volatility normalized momentum indicator (MACD-v). The graphic you provided presents a straightforward formula that is easily comprehensible, simplifying the process of coding it in platforms like Amibroker or Trading View. Even for non-coders, it is as simple as transforming an idea into a mathematical formula, which can be interpreted as code by a program.

Converting this formula into an indicator is a straightforward task. However, transforming that indicator into a trading strategy requires a bit more effort. By conducting backtesting, we can assess whether the idea is worth further development and implementation.

Exploring Alex Spiroglou's idea through a series of posts could indeed hold educational value. However, it is important to present the information across multiple posts to ensure a comprehensive understanding of not only this particular idea but also how it can be combined with different indicators to yield similar results.

It is worth noting, as a disclaimer, that many people often attempt to reinvent the wheel and reimplement well-established concepts as if they were novel and groundbreaking.

Alex Spiroglou's MACD-v code is represented by this mathematical equation

Skate.