- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

@Skate...You are going to change your investment dividend tactics, from passive to active?

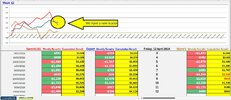

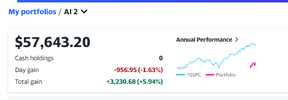

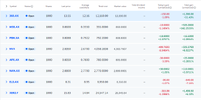

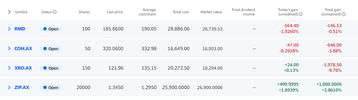

@Rabbithop, I’ve embarked on a personal mission to explore the potential of generating a sustainable passive income for retirees. This income is based on ‘dividends and franking credits’ from a carefully selected 5-position investment portfolio.

This commitment is not a fleeting one. I have dedicated a total of 8 more months to this endeavour. To make this journey more insightful and interactive, I’m sharing the live results every week. This allows others to follow along, learn from the process, and perhaps apply these insights to their financial strategies. It’s an exciting journey, but can this process be improved? which is what I'm trying to answer at the moment.

Skate.