- Joined

- 15 June 2023

- Posts

- 1,209

- Reactions

- 2,668

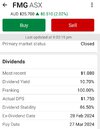

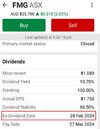

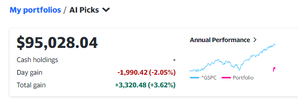

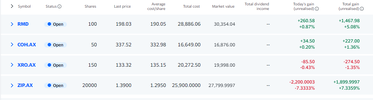

@TimeISmoney, below are two screen captures. The first highlights the payment date being the 28th of March 2024. The second displays the date when I received my dividend for BHP and CBA and FMG.

View attachment 173654

View attachment 173655

Skate.

I've got the confirmation letter from FMG with my HIN number and bank account details but nothing has come through.