- Joined

- 20 July 2021

- Posts

- 12,714

- Reactions

- 17,661

i am wired very differently to most , that post did confirm what i strongly suspectedI deleted my post for a simple reason - no one likes to read lengthy boring posts.

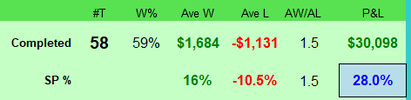

To shorten the post, I'll just display a summary of the strategy's performance in an easy-to-read format. The average profit per trade is relatively low because I'm looking to minimise the risk with this strategy. As I get older risk becomes the most important aspect of my trading.

Trend Momentum Strategy - $100k Portfolio

Total profit: $28,436.75

58 trades

Average profit per trade: $490.29

Winning percentage: 58%

Win/loss ratio: 1.41 (58 wins, 41 losses)

System Drawdown -3.73%

Maximum drawdown: -$4,751.89

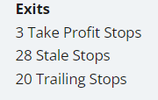

Exits

3 Take Profit Stops

28 Stale Stops

20 Trailing Stops

Skate.

cheers and good luck