- Joined

- 20 July 2021

- Posts

- 12,640

- Reactions

- 17,573

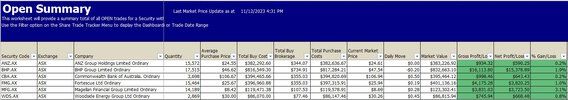

dark side ??I've made a switch to the dark side

I've recently acquired 6 investment positions, and I'm excited to see where this new journey takes me. My decision was a snap decision yesterday, but I had been thinking about the switch for a while.

I based my investment decisions on three key principles

1. Dividends - I wanted to invest in companies that offer consistent and attractive dividends, providing me with a steady income stream.

2. Franking Credits - I looked for companies that offer franking credits, which can increase my overall returns.

3. Capital Gains - I also considered the potential for capital growth, investing in companies with a strong track record of increasing their share price over time "that are currently under pressure or simply out of favour at the moment".

I'm happy that my investment portfolio is now a healthy mix of stability and growth, focusing on the long-term. I'm excited to see how these investments perform.

Skate.

i would call it the slow(er ) lane

but OK a decision is a decision

point 1. can be harder than it looks , look at how many fund managers crow about consistently growing returns

the only successful formula for me in this regard , i buy early and hope ( the company survives the early growth period )

take as an example TNE ( purchased November 2011 @ $1.10 )

the div. yield at current SP is around 1.1% ,

| DIVIDEND TYPE | DIVIDEND AMOUNT ($) | FRANKED | EX-DIV DATE | PAY DATE |

|---|---|---|---|---|

| Final | 0.149 | 60.00% | 30/11/2023 | 15/12/2023 |

| Interim | 0.046 | 60.00% | 01/06/2023 | 16/06/2023 |

| Final | 0.128 | 60.00% | 01/12/2022 | 16/12/2022 |

| Interim | 0.042 | 60.00% | 02/06/2022 | 17/06/2022 |

| Final | 0.101 | 60.00% | 02/12/2021 | 17/12/2021 |

| Interim | 0.038 | 60.00% | 03/06/2021 | 18/06/2021 |

| Final | 0.094 | 60.00% | 03/12/2020 | 18/12/2020 |

| Interim | 0.035 | 59.00% | 28/05/2020 | 12/06/2020 |

| Final | 0.088 | 60.00% | 28/11/2019 | 13/12/2019 |

| Interim | 0.032 | 75.00% | 30/05/2019 | 14/06/2019 |

| Final | 0.082 | 75.00% | 29/11/2018 | 14/12/2018 |

however the return on $1.10 outlay ( and a lot of patience ) is reasonable

2. franking ,

franking credits are in the lap of the gods ( actually the government and board of directors ) future directors might steer more investment internationally and those profits will carry less ( most likely no ) franking credits

there are exceptions like say BHP who seem to determine dividends by available franking credits ( and retain surplus cash for future investment )

3.capital gains

capital gains in a scenario of higher inflation ( and accompanying taxes ) you risk some disappointment here , but good luck there will still be some five and ten baggers over the next ten years , i hope you get your share

an extra thought you may have to adjust the perspective of your maths when making investing decisions , for example , do you bank your gains( dividends) or compound via DRPs ( i do a mix , including partial DRP participation in some shares )

remember the answer is always ... what is best for you ( not me or the tax office )

but welcome and i wish you all the success