- Joined

- 13 February 2006

- Posts

- 5,427

- Reactions

- 12,690

Risk management is #1. If you don't survive, you can no longer play/improve/etc.

Some (most) of the best strategies are relatively simple. Complexity provides the illusion of safety/profitability. It is usually a chimera.

Risk management is not trading bigger size than you can emotionally handle. The losses must be managed quickly before they exceed your emotional ability to deal with them.

You will seriously underestimate your ability to manage losses. Pick the number you think you can manage and then reduce it by 80%.

Something went seriously wrong with a 22% decline. Did it trade (gap) through a stop or something?

Which is a lesson in of itself: stops are not without serious issues in of themselves.

The difficulty here is excessive fiddling with a successful methodology as opposed to evolution/improvement of a methodology. It is a balance.

Interaction with other traders is (a) useful or (b) frustrating. It can be useful if there is an open(ish) sharing of ideas. It is frustrating in as much as most will not discuss details of their strategies/methodologies due to competitive pressures in the markets. That being said "The thing that hath been, it is that which shall be; and that which is done is that which shall be done: and there is no new thing under the sun.” Ecclesiastes. You may think you have 'discovered' the holy grail, unlikely.

So where if anywhere, is there an edge?

Technicals? Hardly. This is essentially the lazy man's route to riches. It's attractive because superficially, it appears easy.

Fundamentals? Unlikely, the levels of dishonesty in financial statements is significant. Unless you know how to break them down, a waste of time for most. The thing with fundamentals is this: assuming you can break them down, you can generally only take advantage of your analysis in a market break. Patience required is extreme.

Macro? Complicated and constantly changing.

Quant: Generally you require a ton of data and the means and knowledge to crunch it. Beyond most of your average retail.

Tech? Which is situating your computers/etc within the exchanges and front running trades. Good luck with that.

As @Skate has alluded, whichever methodology or (ies) you employ, you will need to put in a significant amount of time watching/researching/reading about markets.

Something not mentioned in the plethora of posts: timeframe(s).

Along with 'risk management' the timeframe that you trade is (probably) your next most important decision. Mechanical systems IMO really struggle here. A weekly system that takes prices (exits) mid-week...is that a weekly system or a daily system? A day-trading system that holds overnight (now and then) is not a day-trading system.

The speed at which you need to manage trades is actually a pretty good indicator of the type of market that you are in. Bear markets require grabbing profits quickly before they disappear (long or short). Bull markets tend to reward sitting still doing nothing, read Reminisces. Rangebound markets also necessitate higher frequency trading.

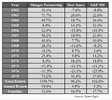

Leverage: If you can use it, it is fantastic. If you can't, it will blow you up. To use it, your drawdowns must not really exceed 2%. Possibly 5% if you have an otherwise high win/loss ratio, but 5% is getting pretty out there. It also needs a decent risk/reward, 2:1 at least. Worthless if you have a 95% win/loss but a 0.1:3 risk/reward. You will blow up.

Profits are lumpy: thinking that you can give up work and earn a weekly income from trading is setting yourself up for a lot of pressure, which will impact your risk tolerance significantly. Needing to make daily/weekly profits, virtually guarantees you will lose money. The thing with trading is that you earn: nothing, nothing, nothing, lose a little, kapow, huge profit.

Compounding: If you are a solid trader, then this works for you. However, it is always prudent to take a little off the table and put it away for a rainy day, other than any other expenses (living if this is your sole income) that need to be taken.

No Boss: trading is very attractive, no boss, no clients, no commute, etc. It's only fun if you are winning. Losing is a soul destroying affair.

Markets/Instruments/Time Zones: trading only stocks can be very limiting. Trading only 1 market can be very limiting. Trading only 1 type of instrument can be very limiting. The best market is the US. The time zone is not friendly for Aus/NZ. It can be traded utilising certain strategies and contingent orders.

jog on

duc