- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

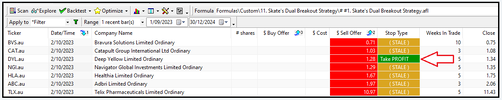

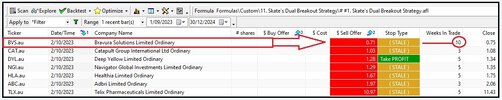

Trading results

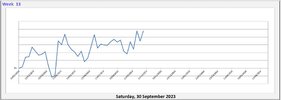

With permission, I'm delighted to share the trading results of one of my three sons, who started a new strategy at the beginning of this calendar year. He understands that trading success doesn't come overnight and that his results will be subject to market volatility. Despite this, he's found it challenging to cope with the ups and downs of his journey.

I'm proud of his dedication and willingness to learn from his experiences. As a trader, it's essential to acknowledge and address the emotional aspects of trading, as they can significantly impact our decision-making and overall performance.

Below are his trading results since the beginning of the year. While they may not be spectacular, they do show a commitment to learning and improving.

As a parent

I'm excited to see his progress and growth as a trader. It's also rewarding to see my son take on new challenges and work towards his goals. I'm grateful for the opportunity to share his journey with you and hope that it may inspire others to pursue their passions and interests, even in the face of adversity.

Skate.

With permission, I'm delighted to share the trading results of one of my three sons, who started a new strategy at the beginning of this calendar year. He understands that trading success doesn't come overnight and that his results will be subject to market volatility. Despite this, he's found it challenging to cope with the ups and downs of his journey.

I'm proud of his dedication and willingness to learn from his experiences. As a trader, it's essential to acknowledge and address the emotional aspects of trading, as they can significantly impact our decision-making and overall performance.

Below are his trading results since the beginning of the year. While they may not be spectacular, they do show a commitment to learning and improving.

As a parent

I'm excited to see his progress and growth as a trader. It's also rewarding to see my son take on new challenges and work towards his goals. I'm grateful for the opportunity to share his journey with you and hope that it may inspire others to pursue their passions and interests, even in the face of adversity.

Skate.