- Joined

- 13 February 2006

- Posts

- 5,286

- Reactions

- 12,185

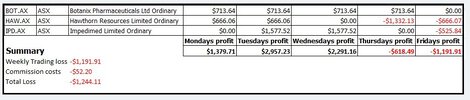

Pretty rough week on ASX:"Trading for Beginners - Skate's Practical Guide to Profitable Trading"

A daily series of posts aimed at those just starting out on their trading journey.

62. Managing trading positions

It is critical to overcome the fear of selling in order to efficiently manage trading positions. Rather than holding onto a position in the hope of seeing it improve, it is best to sell when it is no longer performing as expected. This requires a well-defined exit strategy that corresponds to your risk tolerance and personal preferences.

It is important for traders to understand that there is no one-size-fits-all method to trading and it's imperative to develop their own strategy appropriately. Long-term success requires learning from losses and altering strategies in response to changing market conditions. Strategy improvements are always ongoing.

While knowledge is vital, putting that information into practice is what produces outcomes. Trading success, like success in every other field, needs not only knowledge but also action.

Traders should expect losses, trading errors, and setbacks along the way. Learning from these experiences and fine-tuning their strategy accordingly can go a long way to achieving long-term trading success. The ability to adapt based on knowledge and experience is a valuable asset for building wealth over time.

Despite the number of trading analysis resources available, such as trading books, YouTube, Twitter, and dedicated websites, many traders struggle to regularly earn a profit. Nonetheless, traders can boost their chances of success and reach their trading objectives with dedication, enthusiasm, and gained experience.

The truth is that most traders who try to make money through trading will fall short. This is caused by a variety of reasons, including the market's high degree of unpredictability, the complexity of the market, and the impact of emotions on a trader's decision-making process.

Skate.

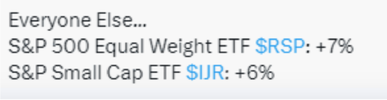

With only 3 positions opened, the system was pretty good in keeping you out of the market. I guess all those filters were working!

jog on

duc