- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

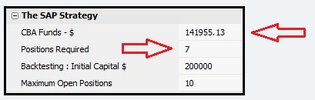

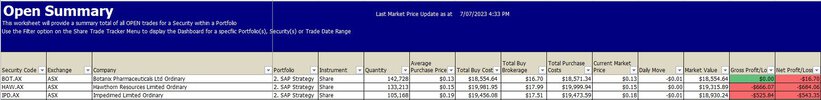

There's only one way to test the robustness of a system, and that's to run a walk-forward analysis. I've only managed a successful WF analysis once, and it was a system that eventually broke down! So even passing a WF is not an ironclad guarantee. A good mechanical system will probably generalize quite well to other exchanges, like NYSE or NQ. Being a momentum system, I'd assume SAP maintains profitability on American markets.

Discretionary systems can only be tested with paper trading, which is what I'm doing currently. Slow porcess. The aim is to get to a point where there's no tweaking or changing of anything. It should begin to approximate a mechanical system, even if it's something that cannot be easily coded. I know everything can be coded, but only in theory. It costs a lot of money and all platforms have limitations, especially in regards to working with tick data.

Discretionary systems can only be tested with paper trading, which is what I'm doing currently. Slow porcess. The aim is to get to a point where there's no tweaking or changing of anything. It should begin to approximate a mechanical system, even if it's something that cannot be easily coded. I know everything can be coded, but only in theory. It costs a lot of money and all platforms have limitations, especially in regards to working with tick data.