- Joined

- 13 February 2006

- Posts

- 5,286

- Reactions

- 12,184

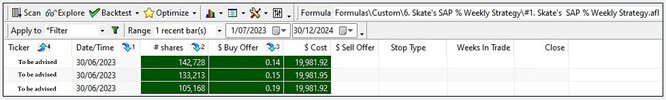

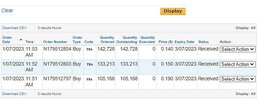

My 2022-2023 return was 21.875%

Returns in the world of trading this financial year were variable and unpredictable. In the instance of my 2022-2023 return, I began well and finished with a good 21.875% return. My euphoria, however, was short-lived, as I was slammed with a string of weekly losses around the end of January 2023.

This event emphasises the volatility and danger inherent in trading since even the most successful traders might meet unforeseen challenges. The red lines within the circle remind us that trading requires ongoing monitoring and agility. While losses are unavoidable, they also provide an opportunity to learn and improve future trading techniques.

View attachment 158924

Skate.

Is the %Buy a new filter? Or is it a modification/evolution?

The comparison of your results to the market would seem to suggest that the correlation is quite high. Not surprising with a long stocks strategy.

From Sept. 2022 where you had had some drawdown, you could be confident that the system was not broken due to the correlation? This really goes to my question: how do you know the system is broken as opposed to just a drawdown.

Of course the follow up question is: given that the system is not broken, what would you expect if the market had continued lower?

That is to say: could the system buck the trend of the market?

jog on

duc