- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

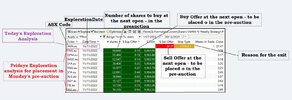

Skate's Trading Rules

# If positions aren't executed at the open "the position stays open during the day" & purged after the close.

Important

"Never buy at the market", the position needs to be executed at the "Offer" or not at all.

The Buy Rules

1. The "Buy offer" is good for one day only

2. Never chase the price.

3. There are some positions that you will miss because of a gap-up

4. Positions not executed during the day need to be purged after the close

5. Do not "carry over" orders (positions need to be executed on the same day)

6. The buy rules are not flexible

The Sell Rules

1. Never sell before a signal is given

2. Sell in the pre-auction at the "Offer"

3. If the position is not sold in the pre-auction wait till 10:30 am for the market to settle

4. If the position is still open after 10:31 am - sell immediately "at the market"

5. The sell rules are not flexible

Skate.

# If positions aren't executed at the open "the position stays open during the day" & purged after the close.

Important

"Never buy at the market", the position needs to be executed at the "Offer" or not at all.

The Buy Rules

1. The "Buy offer" is good for one day only

2. Never chase the price.

3. There are some positions that you will miss because of a gap-up

4. Positions not executed during the day need to be purged after the close

5. Do not "carry over" orders (positions need to be executed on the same day)

6. The buy rules are not flexible

The Sell Rules

1. Never sell before a signal is given

2. Sell in the pre-auction at the "Offer"

3. If the position is not sold in the pre-auction wait till 10:30 am for the market to settle

4. If the position is still open after 10:31 am - sell immediately "at the market"

5. The sell rules are not flexible

Skate.