Your coding will take me a while to understand, if I even get to that point. So that's a bit of a difficulty for me.

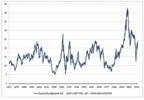

If tomorrow's close is higher than today's (by any amount), then today is a trough...and vice versa. In what situation would this not be the case? Like a specific date where a trough occurs on BHP and it's not possible to safely buy the following day's close.

I have done all i can

This topic is closed.