- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

How I approached finding good trade entries

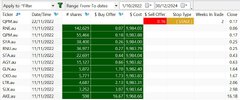

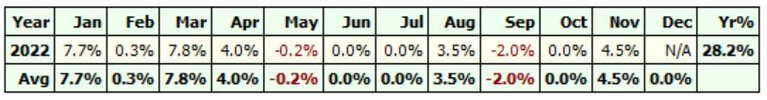

Momentum measures how quick & strong a price move is. When trend trading we need to be constantly looking for momentum before a breakout. If you go too early or too late I believe a world of pain awaits. Confirmation is required before you make a move & at times waiting for confirmation can be the hardest part of trading my way.

Entry confusion

Most traders are constantly obsessing about where & how to get into the market. Entry confusion happens to us all & it's for this very reason that trading systematically works. Why? because all your rules can be precisely coded for optimal performance. With so many entry styles to choose from many "trading gurus" will tell you what supposedly works but they rarely tell you what doesn’t. I start to wonder if these trading gurus ever follow their own _bullshit_. My piece of advice today is to forget about focusing on when to get into the market but rather figure out "when to stay out" of the market.

Summary

Using momentum as a forerunner to a breakout works, it's as simple as that. Anytime there is a significant move in the markets, momentum is a part of it. Without momentum, it will end up being a false breakout, these are the breakouts you need to avoid.

Skate.

Momentum measures how quick & strong a price move is. When trend trading we need to be constantly looking for momentum before a breakout. If you go too early or too late I believe a world of pain awaits. Confirmation is required before you make a move & at times waiting for confirmation can be the hardest part of trading my way.

Entry confusion

Most traders are constantly obsessing about where & how to get into the market. Entry confusion happens to us all & it's for this very reason that trading systematically works. Why? because all your rules can be precisely coded for optimal performance. With so many entry styles to choose from many "trading gurus" will tell you what supposedly works but they rarely tell you what doesn’t. I start to wonder if these trading gurus ever follow their own _bullshit_. My piece of advice today is to forget about focusing on when to get into the market but rather figure out "when to stay out" of the market.

Summary

Using momentum as a forerunner to a breakout works, it's as simple as that. Anytime there is a significant move in the markets, momentum is a part of it. Without momentum, it will end up being a false breakout, these are the breakouts you need to avoid.

Skate.