Hi peter2,Pleased to see you start with a market "sentiment" indicator.

Your version 2 looks a bit spotty, too intermittent and it's more off than on even when the index is rising.

(edit: You may be planning on "smoothing" it. sorry if I posted early.)

A mkt filter based on your Ducati blue bars indicator on the XAO would look better.

Do you mean something like this?

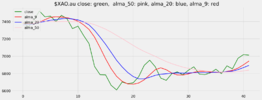

$XAO.au is the Norgate code for All Ordinaries, here for past 42 days, green line is the 'close' price.

The pink, blue and red lines being respective ALMA moving averages for 50, 20 and 9 days.

Bearing in mind I still have my trader's training wheels still on this graphic suggests the market started a positive move about six days ago.

Cheers, e.