- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

The metrics you indicate are important to you also make sense to me, except the 'Stale Stop', could you elaborate?

If you do a search, there would be at least 60 posts that I've made on the subject.

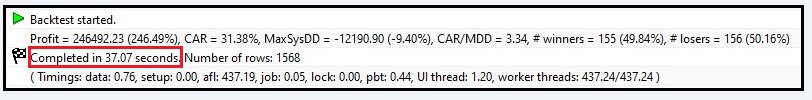

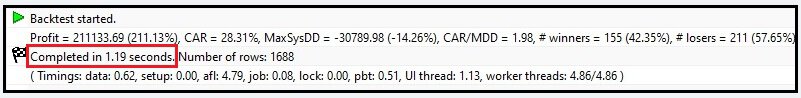

Is it possible to re-run you code and report the backtest results for say the approx five years only 2018 to 2022?

I am interested to see how the more recent data pans out.

Sure, no worry. I'll be out of the office for about an hour & will post them on my return

Skate.