- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Reposted without permission

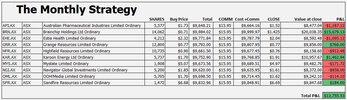

The recent market trend nearly guarantees most trend traders will be losing money to some degree because when "financials & miners" take a beating, the overall market takes a beating. As a general rule when the big two make waves the overall market "turns down" splashing everything else.

Skate.

The recent market trend nearly guarantees most trend traders will be losing money to some degree because when "financials & miners" take a beating, the overall market takes a beating. As a general rule when the big two make waves the overall market "turns down" splashing everything else.

Skate.

if i did that in 2020 I'd be poorer than i am today

if i did that in 2020 I'd be poorer than i am today