- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Is it really possible to trade a monthly momentum strategy?

I have a simple idea about trading & realised the only way to make a profit is by finding stocks that are moving. After starting the "Monthly Momentum Strategy" with "enthusiasm & vigor" I'm now concerned about how to extract the maximum amount of money from the market with minimal risk. Trading a long-term momentum strategy doesn't make sense to me at the moment after thinking about it a little more. When your money is on the line you will think about trading differently than talking about the methodology. Well, to tell you the truth I feel that it will be "near impossible" for this type of strategy to work as intended with such uncertainty in the markets at the moment.

Why?

For a few reasons really. Short-term momentum traders seek to identify strong trends to take advantage of the expected price change. "Short-term" momentum trading buys when the price is rising & sells them when they have peaked. The goal is to work with volatility by finding buying opportunities in short-term uptrends (Not long-term trends) & exits at the first sight of losing momentum. The whole premise of this type of strategy is based on the idea that if there is enough force behind a price move, it will continue to move in the same direction. Staying with this strategy "month on month" will certainly test anyone's mettle & certainly it will test mine.

Momentum trading is similar to breakout trading

The issue I see is when an unforeseen negative event occurs during the trading month it will force the price lower without the ability to counteract against such moves in the short term. My monthly momentum strategy doesn’t attempt to find the top or bottom of a trend but instead focuses on the main body of the price move "trying to exploit" market sentiment by follow the majority.

Summary

Backtesting indicates a monthly momentum strategy has worked in the "past" but the lingering question I'm asking myself is this - will a "monthly momentum strategy" be able to withstand the riggers of trading the current short-term volatility?

Skate.

I agree with Mr Ducati, currencies would provide you with trends tradable on a monthly basis, but i suspect that without leverage, it is not really worth while.Afternoon Mr Skate:

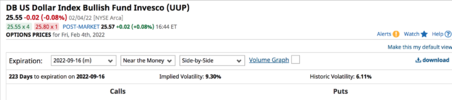

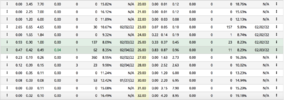

Currencies are ideal for monthly based trending systems. Nice long lasting trends.

View attachment 137109View attachment 137110View attachment 137111

jog on

duc

I agree with Mr Ducati, currencies would provide you with trends tradable on a monthly basis, but i suspect that without leverage, it is not really worth while.

If you stick to the ASX, currency ETFs will not provide you with the tools you need, and you might not be able to backtest with your data feed..

Nice succinct summary of some key system performance metrics for back-testing, what those metrics mean and what values to keep an eye out for.

https://www.quantifiedstrategies.com/trading-strategy-and-system-performance-metrics/

anyone have you ever looked into a dynamic trading system?

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.