- Joined

- 20 July 2021

- Posts

- 12,005

- Reactions

- 16,713

buy and hold is for folks earning a healthy income elsewhereIn a friendly way I often remind my daughter that buy and hold is for lazy folks that don't know what they're doing--she has a buy and hold approach.

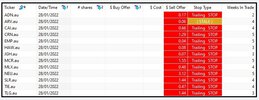

Well this morning she asked me to check in on the performance of her holdings--much to our great surprise she is up almost 6% from 1 January. So today she is making me eat **** sandwiches for lunch

View attachment 136654

that doesn't mean some don't WATCH and deploy extra cash strategically