- Joined

- 24 December 2005

- Posts

- 2,601

- Reactions

- 2,066

Sure, I am a retail trader, at least I trade and not only do I trade I call my shots in public, here...This statement sums you up perfectly. Sigh...retail traders

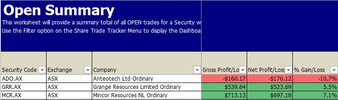

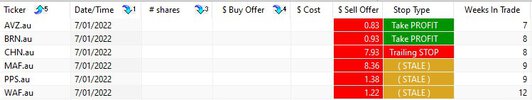

KISS Trading with Ann

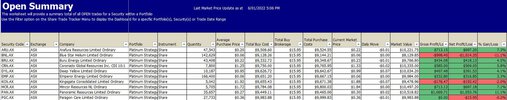

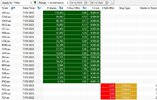

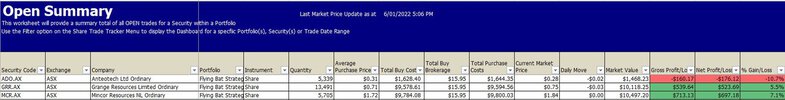

Just for fun, I thought I would try for a portfolio of 10 shares/ETFs built up over three months and held until they break through a vital trendline/resistance and get sold. This will all be done manually with IC charts. I will eyeball the charts, draw my support and resistance trendlines and...

www.aussiestockforums.com

www.aussiestockforums.com