MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

This speaks volumes--look what preceded the GFC market crash in Oct of 2007. All those shitty sub prime residential mortgage backed securities--their underlying assets of over-valued housing saw a rapid devaluation starting early 07. The bubble had burst.

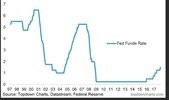

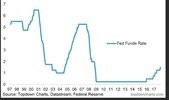

Meanwhile the official US cash rate (interest rate)--which you can see below--was consistently increasing in the lead up to the 2007 crash. This ever increasing interest rate certainly didn't dampen the performance of the US market or residential property prices. But once the bubble burst on the over-priced residential housing assets the official cash rate dropped right off. Again, this falling interest rate did nothing to stop the US market crashing.

Meanwhile the official US cash rate (interest rate)--which you can see below--was consistently increasing in the lead up to the 2007 crash. This ever increasing interest rate certainly didn't dampen the performance of the US market or residential property prices. But once the bubble burst on the over-priced residential housing assets the official cash rate dropped right off. Again, this falling interest rate did nothing to stop the US market crashing.

. Think I just stick to old school position sizing

. Think I just stick to old school position sizing