- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

@Skate and others, the insight you provide makes my brain juices flow. The research doors are wide open. Particularly the last few posts. Thank you

Uurgh, they are just like bloody party streamers all over my charts. I tried them out for about a minute when Colin added them to the indicators list until the untidiness and unnecessary junk got in my way.

Guppy's Multiple Moving Averages

As trend trading strategies go, using "Guppy's Multiple Moving Averages" would be a suitable choice as it's easy to follow & understand. The relationship between the 12 exponential moving average (EMA) tells the story of long & short-term buyers.

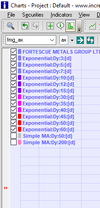

Guppy's Multiple Moving Averages (GMMA)

The multiple lines of the Guppy help traders see the strength or weakness in a trend better than if only using one (or two) EMAs. The 12 EMAs are separated into two groups. Compression to the expansion of the “lines of the ribbon” tells one story whereas the reverse (expansion to compressions) tells another. On the other hand, the "crossing" of the ribbons, is a whole other story in itself. The GMMA ribbon (the indicator) identifies the trend, the strength of the trend & the reversal of the trend.

GMMA Ribbon Colours

The short-term investors are represented by the “Blue Ribbon” & the longer-term investors are represented by the “Red Ribbon”. To keep the post short, those interested can do their own research as to how these lines (of the ribbon) interact. We can use the association of the "GMMA ribbon" (the lines) to our advantage. The downside to (GMMA) it’s a "lagging indicator" that will never catch the low of the pivot but at times goes very close.

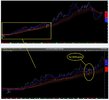

Twisting the GMMA

I’ve twisted Guppy’s idea. I've taken the average of Guppy's slow & fast-moving (EMA's) then added a smoothing factor. Using the average of the EMA bands (IMHO) sharpens the usefulness of the indicator allowing me to turn the GMMA indicator into a complete trend trading strategy.

Weekly (FMG) Chart

Guppy's MMA - 2 year backtest

This backtest includes the COVID period to demonstrate how this strategy handled this trading period. Overall it was mighty disappointing but overall it recovered nicely.

Guppy's MMA

Don't forget I’ve twisted Guppy’s idea. I've taken the average of Guppy's slow & fast-moving (EMA's) then added a smoothing factor. This in itself is worthy of the exercise. Twisting it up, I've used the average of the EMA bands to sharpen the usefulness of the indicator allowing me to turn the GMMA indicator into a complete trend trading strategy. It's not a perfect trend trading strategy but it's simple to follow & implement. In my opinion, don't discard Guppy's idea too quickly as a trend following system or indicator. (more lines are better than one)

Summary

The 'Dump it here' thread is about ideas, ideas that I've found helpful in my trading experience.

Skate.