- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Most fail to realise rebalancing works both ways

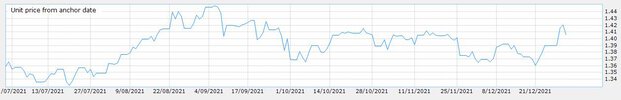

Re-balancing the next bet works for me as I need all my available funds to be constantly in the markets. Most fail to realise re-balancing works both ways. When trading is not going well, the size of the next bet decreases because of the losses incurred, even a string of losses is reflected. Boy, when times are good why shouldn't I take advantage of these conditions & increase my bet sizes. It's "making hay while the sun shines".

In summary

If you are backtesting & "not live trading" it would be advisable to backtest "only with a fixed dollar amount" ensuring that the backtest results will be accurate, constant, believable & achievable. The backtest period becomes irrelevant using a fixed dollar amount. Using any other method "cooks the books" & certainly "skews the results". Well, it's a first for me to learn others backtest using methods other than the "Fixed Dollar Amount".

Skate.

Re-balancing the next bet works for me as I need all my available funds to be constantly in the markets. Most fail to realise re-balancing works both ways. When trading is not going well, the size of the next bet decreases because of the losses incurred, even a string of losses is reflected. Boy, when times are good why shouldn't I take advantage of these conditions & increase my bet sizes. It's "making hay while the sun shines".

In summary

If you are backtesting & "not live trading" it would be advisable to backtest "only with a fixed dollar amount" ensuring that the backtest results will be accurate, constant, believable & achievable. The backtest period becomes irrelevant using a fixed dollar amount. Using any other method "cooks the books" & certainly "skews the results". Well, it's a first for me to learn others backtest using methods other than the "Fixed Dollar Amount".

Skate.