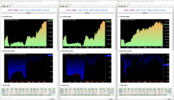

The charts above just show us how good that period coming out of the COVID crash really was for breakout type systems.

I am at the stage now that when I look at back tests that cover the few months commencing February / March 2020, that I look at individual trades, and discount the back test results for the couple of outliers that usually appear.

KH

I am at the stage now that when I look at back tests that cover the few months commencing February / March 2020, that I look at individual trades, and discount the back test results for the couple of outliers that usually appear.

KH