- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

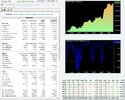

The intention of the code wasn't to be a profit taker, ill put that down to good luck.

@othmana86 let's not mention the word "luck" again as it flames a different range of opinions. Let's use the words "good fortune" instead of "luck" as it might be more palatable to some. In hindsight, I should have selected a more appropriate word to express my opinion. I'm glad you & @DaveTrade have shifted the conversation to trading & trading ideas as it gives me a segue to change the conversation.

Trading ideas

Profiting from the stock market is exceedingly difficult to do consistently over a long period of time. We all have opinions of what works & what doesn't when it comes to trading but always find it difficult to have the confidence in putting our money on the line trading our own idea(s). Very few people succeed in this process as the learning curve is too steep, time-consuming & at times hard to implement with confidence. Outsourcing the process as @Cam019 & @Warr87 have done is an alternative to going it alone.

You need a certain amount of "Good Fortune"

No matter how smart we are, or how hard we work, we will regularly be hit by unforeseen, unknowable new information. No matter the amount of backtesting can foresee unpredictable & unpreventable events as @qldfrog often refers to. Skilled traders are nothing more than calculated risk-takers.

Timing is critical at each stage of trading

Your trading ability comes from within by executing your trading plan consistently with confidence. Getting the entry & exit timing correct is the bread & butter of a mechanical system trader. It also pays to remember with system trading there are no "good trades" or "bad trades". There are only trades that "work" & trades that "don't".

Skate.