- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

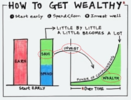

@Trendnomics makes a valid but with all-new strategies, they take time to develop.It is mind boggling how much money you can extract from the market as a retail trader, with the right amount of discipline, fortitude and conviction.

There is never a good time to start tradingpersonally worried by the markets and situation but following my systems..

Luck & timing plays a significant role in the performance of any portfolio & as they say "there is never a good time to start trading". Traders need to be aware of the significance "luck & timing" will have when trading a new strategy.

Things may not go well for this strategy in the short-term

The starting date can have a big bearing on the performance of a strategy in the short term but hopefully, things will settle over the longer term. "The Platinum Strategy" will take time to develop as the markets are in turmoil at the moment, so let's be patient with the performance of my new project & hope for the best.

Follow the signals without thinking

As @qldfrog pointed out in recent posts, following your buy & sell signals consistently will be the key to the profitability of a strategy (even when you are not in agreeance with the signals).

Skate.