- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Let's now talk about consistent, effective trading

The above short video explains how wealth can be created with a little discipline.

My current project

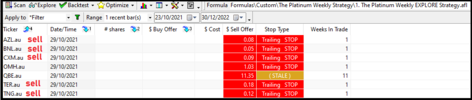

I have a high conviction that "The Platinum Strategy" is the correct strategy to trade at the moment under these "trying conditions". The Platinum Strategy has been systematically coded to be responsive to the "current" market conditions. Trading the strategy as a "weekly" has its advantages by allowing for the natural ebb & flow of the markets, but in saying this the strategy is ultra-conservative in its approach. The buy condition is strict in selecting positions but also exits at the first sign of a confirmed change of conditions. Trading this way is the safe as I can possibly make it.

Skate.

The above short video explains how wealth can be created with a little discipline.

My current project

I have a high conviction that "The Platinum Strategy" is the correct strategy to trade at the moment under these "trying conditions". The Platinum Strategy has been systematically coded to be responsive to the "current" market conditions. Trading the strategy as a "weekly" has its advantages by allowing for the natural ebb & flow of the markets, but in saying this the strategy is ultra-conservative in its approach. The buy condition is strict in selecting positions but also exits at the first sign of a confirmed change of conditions. Trading this way is the safe as I can possibly make it.

Skate.

but just a good charting package.

but just a good charting package.