- Joined

- 8 June 2008

- Posts

- 14,055

- Reactions

- 21,156

This is crazy MA, usually i develop a system, test on a few time periods and then look at AB MC.@Newt Here's a quick and dirty example for you. This assumes you are using the latest version of Excel. Also assumed you know how to export the results out of AB into a CSV (which you do).

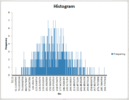

Referring to the pic below, all you do is open the CSV file (from AB) in Excel and then you will see in the top right hand corner there is an "Analyze Data" button. Click it and you will be presented with the Analyze Data options on the righthand size. You can see it is even showing a pre-packaged histogram option (frequency). You just click on that and hey presto a histogram is automatically generated for you--don't need to worry about formulas etc. See the second image below. You can do this analysis on whatever column of data you want. The Analyze Data option is a fantastic tool and allows you to do a lot of statistic analysis on your data--it's an invaluable tool. More on that tomorrow.

As a related but side issue--a very important aspect of any system is positive expectancy. You can see from the second picture below that based on the 1000 runs shown in the first figure that this system has a positive expectancy, that is none of the 1000 runs returned a negative net profit. However, if you look at the third image below AB's MC analysis certainly does not show that the same system has a positive expectancy with only around 10% of the 1000 runs returning a positive return--according to AB 90% resulted in complete capital loss. This is not because AB has some amazing way of doing MC--as I mentioned previously it is flawed.

View attachment 127833

View attachment 127834

View attachment 127835

On results like that,i would back off.

AB is not only wrong but also very misleading.

So far after running 2h on Guppy and FB, seems ok just looking thru results but still have to go thru excel.

I did a miss of 20% of buys, via random function.will put the result of the experience on my thread.

Social life awaits before we get in lockdown too