- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

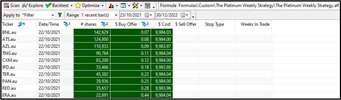

The Platinum Strategy

Let me explain the inner working of this strategy as it relies heavily upon an ADX indicator for a buy signal which measures the strength of a trend. It's a handy indicator that works perfectly in both trending & range-bound markets. As well as the ADX indicator buy signal "The Platinum Strategy" use a confirming indication of a "Volume Weighted Moving Average" over two different time periods to indicate when a price is trending higher. Both these are conditional on the "Ulcer index indicator" is "Down".

Summary of the Ulcer Index

The Ulcer Index’s real strength is its focus on downside risk only. A gap-up would be viewed with joy, while a gap-down would be viewed with horror. The Ulcer Index focuses on downside risk rather than the upside. The downside risk causes "stress" when trading. The main idea behind the Ulcer Index Indicator is to measure downward volatility & alert when the trade reaches a level of “stress”. The "Stress" indicator is either UP or DOWN.

Thinking outside the box

Nobody that I know uses the "Ulcer Index" to their advantage & this indicator forms part of "The Platinum Strategy". The Ulcer Indicator's sole purpose is to control the drawdown risk (not eliminate the risk) without reducing the profit potential of a strategy.

Skate.

Let me explain the inner working of this strategy as it relies heavily upon an ADX indicator for a buy signal which measures the strength of a trend. It's a handy indicator that works perfectly in both trending & range-bound markets. As well as the ADX indicator buy signal "The Platinum Strategy" use a confirming indication of a "Volume Weighted Moving Average" over two different time periods to indicate when a price is trending higher. Both these are conditional on the "Ulcer index indicator" is "Down".

Summary of the Ulcer Index

The Ulcer Index’s real strength is its focus on downside risk only. A gap-up would be viewed with joy, while a gap-down would be viewed with horror. The Ulcer Index focuses on downside risk rather than the upside. The downside risk causes "stress" when trading. The main idea behind the Ulcer Index Indicator is to measure downward volatility & alert when the trade reaches a level of “stress”. The "Stress" indicator is either UP or DOWN.

Thinking outside the box

Nobody that I know uses the "Ulcer Index" to their advantage & this indicator forms part of "The Platinum Strategy". The Ulcer Indicator's sole purpose is to control the drawdown risk (not eliminate the risk) without reducing the profit potential of a strategy.

Skate.