- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

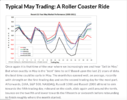

Slightly off topic - many people who trade systems (and probably discretionary traders too) have had less than spectacular returns in April compared to the earlier months of the year. The XAO is at record highs just about. What indicator (eg sentiment, Adv/Decline, VIX, momentum etc etc) can pinpoint the change in the market? Any thoughts or ideas appreciated

What indicator can pinpoint the change in the market?

@martyjames I've made over 34 separate posts just on the indicators that I use in my trading. The search feature is you friend but as a refresher, most of my strategies uses volatility & momentum indicators to enter & exit positions. There is a multitude of indicators that can help identify the direction, strength, momentum & volatility but there are two indicators (ROC & ATR) to keep it simple. Typically, most strategies gauge momentum & volatility during price consolidation & retracements which could be something new to try.

Trend Indicators

A few simple trend indicators are all you need to see when to enter a position. Entries during trends require almost no brain cells. (ATR) is a volatility indicator, combined with a momentum indicator (ROC) tells a powerful story. A Commodity Channel Index (CCI) is a momentum-based oscillator used to determine overbought or oversold conditions but this indicator is best used in conjunction with additional indicators. The Rate-of-Change (ROC) is another handy indicator & I use the ROC indicator in every strategy that I code to confirm the increasing momentum of a trend.

What drives a trend?

"Volatility & Volume" are the real driver of a trend - meaning we enter a trend on volatility & volume - getting off when the trend turns. It pays to do your own research to find indicators that will work for you. Getting into a trend is not that difficult using an indicator, using two is sometimes better. Getting out of a trend & timing the exit is a little more complex.

More here

Skate.