- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

We all enjoy a new hobby

Recently I made a post that "I quickly deleted" asking for advice on how to get my enthusiasm back when it comes to trading. I enjoyed the thrill of trading & to be honest initially it was fun, but like a golf game, it became an obsession.

I received a private message last week

A member suggested a couple of good "system" trading books that he was currently reading & thought I might like to read them as well. Another suggestion was to investigate a different trading system "software" as an alternative to Amibroker.

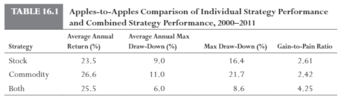

Building Reliable Trading Systems (Keith Fitschen)

One of the trading books he is reading did give me the inspiration to become more involved, getting me out of a slight slump reinvigorating my mojo as trading had become boring for me. Initially I was drawn to the book because of its title "Building Reliable Trading Systems". After reading it I realised the book aligned with my belief "how to trade profitably". The similarities with my trading methodology & the words expressed by Keith Fitschen were simply amazing.

Skate.

Recently I made a post that "I quickly deleted" asking for advice on how to get my enthusiasm back when it comes to trading. I enjoyed the thrill of trading & to be honest initially it was fun, but like a golf game, it became an obsession.

I received a private message last week

A member suggested a couple of good "system" trading books that he was currently reading & thought I might like to read them as well. Another suggestion was to investigate a different trading system "software" as an alternative to Amibroker.

Building Reliable Trading Systems (Keith Fitschen)

One of the trading books he is reading did give me the inspiration to become more involved, getting me out of a slight slump reinvigorating my mojo as trading had become boring for me. Initially I was drawn to the book because of its title "Building Reliable Trading Systems". After reading it I realised the book aligned with my belief "how to trade profitably". The similarities with my trading methodology & the words expressed by Keith Fitschen were simply amazing.

Skate.