- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

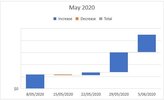

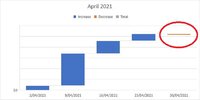

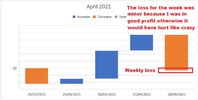

"Sell in May & Go Away"

@ducati916 suggests a pattern of "Sell in May" might be the "real thing" or it simply could be "confirmation bias" of traders. To his credit Duc will be putting this theory to the test, trading his "Swing System" in May. Historically, the market declines around May but it could simply be a "lack of enthusiasm" as historically (May) has shown lacklustre performances in the past.

The month of May gets a bum rap

Market "fluctuations" happen in all times frames but in this game, you need to be "in it to win it".

Doom & gloom is always lurking

Combine that with the month of May & it could be a recipe for disaster, but who really knows?

What I do know

The likes of @ducati916, @peter2, @qldfrog, & @Warr87 to name just a few, won't be on the side lines in cash during the month of May, neither will I.

Hickety-Pickety trading just doesn't cut it for me

Picking just one time period (May) paints a picture to suit the narrative whereas trading results should be the cumulations of the entire "yearly" period.

Farting around can be the undoing of a good strategy

As system traders, we have one job to do & that is to take the signals irrespectively of what you "think" might transpire in a certain month. (May)

Skate.

@ducati916 suggests a pattern of "Sell in May" might be the "real thing" or it simply could be "confirmation bias" of traders. To his credit Duc will be putting this theory to the test, trading his "Swing System" in May. Historically, the market declines around May but it could simply be a "lack of enthusiasm" as historically (May) has shown lacklustre performances in the past.

Whether or not May is a clanger, just beware, this is now very much a shoot first ask questions later market.

The month of May gets a bum rap

Market "fluctuations" happen in all times frames but in this game, you need to be "in it to win it".

Doom & gloom is always lurking

Combine that with the month of May & it could be a recipe for disaster, but who really knows?

What I do know

The likes of @ducati916, @peter2, @qldfrog, & @Warr87 to name just a few, won't be on the side lines in cash during the month of May, neither will I.

There are whackos talking doom and gloom all over the internet competing with their opposite numbers spruiking fortune, but there are some very respectable people issuing warnings with good fundamental reasons and I believe them. I regard the present as 'High Fire Danger' times, that is my gut feeling.

I too feel exceptionally uneasy about the "strength" of the current market. IMV far too many people swimming naked. I suspect the triggers will be the economic fallout from COVID in India, Brazil and some other countries currently under siege. I suspect a collapse will be very, very quick. I think the widespread speculation in crypto currencies and the risk of most of them imploding is also underestimated.

Hickety-Pickety trading just doesn't cut it for me

Picking just one time period (May) paints a picture to suit the narrative whereas trading results should be the cumulations of the entire "yearly" period.

Farting around can be the undoing of a good strategy

As system traders, we have one job to do & that is to take the signals irrespectively of what you "think" might transpire in a certain month. (May)

Skate.