- Joined

- 28 August 2022

- Posts

- 7,020

- Reactions

- 11,351

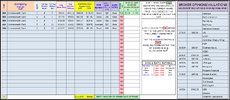

Getting used to the new specks Typo should be blokeAfter seeing mostly red on my watchlist today, that wonderfully wise sage, the blke in the mirror, he's been absent of recent times, thought WC8 might be worth a squizz and suggested a buy in at 0.705 Finished the day at 0.72 so his crystal ball gazing was good.