Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Re: DOW Analysis

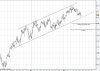

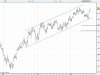

While looking for the length of recovery time from the 1987 market decline, this longer time frame view of activity has shown me that if (that two letter word again) the worst comes out of this present scenario then there will be some solid rebounds during the process.Back on upward trend in months or years is now in play soooo remembering that most people are optimistic and it is an Olympics year with the Chinese hosting then maybe, just maybe, the storm clouds will clear and a slow recovery begin to take place.

If i remember i`ll check this post later in the year to see what has eventuated.

While looking for the length of recovery time from the 1987 market decline, this longer time frame view of activity has shown me that if (that two letter word again) the worst comes out of this present scenario then there will be some solid rebounds during the process.Back on upward trend in months or years is now in play soooo remembering that most people are optimistic and it is an Olympics year with the Chinese hosting then maybe, just maybe, the storm clouds will clear and a slow recovery begin to take place.

If i remember i`ll check this post later in the year to see what has eventuated.