- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

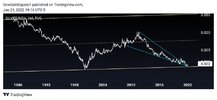

What's wrong with ASX200 ?FWIW There's a few "black box" type indicators I keep a watch on so far as indices are concerned. Nothing fancy, just sites which compile multiple technical indicators into a single number and things like that.

The S&P500 looks healthy but there's a few alarm bells ringing so far as the ASX200 is concerned.

I don't trade directly based on that, it's just background information, but still.