- Joined

- 31 March 2015

- Posts

- 477

- Reactions

- 865

Few pedictions come to pass and the gurus that do get it right keep on with the same prediction for a long time till it actually happens and then say "I told you so", but their timing is poor.

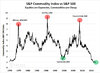

I suspect the markets will re test the lows again and my own cycle work suggests 2022 for a meaningful low, but my gut says that market conditions might be similar to the 1968 to 82 net sideways period in the US.

This is actually worse than full blown extended crash because that usually finishes quite quickly and it's back to buy & hold bull market business. But if markets are sideways for quite a few years it 1/.Confuses the hell out of most participants and 2/ Buy and hold strategy does not work unless you are willing to hold for a very long time.

In that sort of market timing is the key and it's no wonder that the best early cycle technicians first came on the scene during the late 60s and 70s...

I suspect the markets will re test the lows again and my own cycle work suggests 2022 for a meaningful low, but my gut says that market conditions might be similar to the 1968 to 82 net sideways period in the US.

This is actually worse than full blown extended crash because that usually finishes quite quickly and it's back to buy & hold bull market business. But if markets are sideways for quite a few years it 1/.Confuses the hell out of most participants and 2/ Buy and hold strategy does not work unless you are willing to hold for a very long time.

In that sort of market timing is the key and it's no wonder that the best early cycle technicians first came on the scene during the late 60s and 70s...