- Joined

- 12 January 2008

- Posts

- 7,510

- Reactions

- 18,859

Agree with the last few comments.

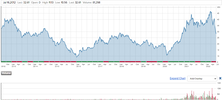

Copper seems to be indicating 100% chance of a hard recession in world markets. Which I don't agree with. I think any recession will be minimal both in time and severity (unemployment is low). IMO the fall in POC is oversold and the rally should be quick and bouncey. The "V" pattern is not my fav pattern to trade, but OK if prepared for it.

China buying copper from Russia, under the table - hmm, this could very well be true. If true, then copper won't bounce and the reversal would be much slower and smoother (easier to trade, but not as lucrative).

Copper seems to be indicating 100% chance of a hard recession in world markets. Which I don't agree with. I think any recession will be minimal both in time and severity (unemployment is low). IMO the fall in POC is oversold and the rally should be quick and bouncey. The "V" pattern is not my fav pattern to trade, but OK if prepared for it.

China buying copper from Russia, under the table - hmm, this could very well be true. If true, then copper won't bounce and the reversal would be much slower and smoother (easier to trade, but not as lucrative).