- Joined

- 29 January 2006

- Posts

- 7,230

- Reactions

- 4,485

That's fine if you can quantify the contribution of a company towards global output, but none of your three posts on Antilles tells us much at all.to be honest as this thread is generically called "copper" I felt it relevant to mention new potential supply projects and any timelines around those, given the whole copper / EV thing is about demand exceeding supply, especially with there being little investment in Copper mines over the past 4 decades.

Unlike another gold related thread, which is named "Gold Price - where is it heading ?"

Maybe this thread can be renamed if its intended purpose is simply price charts and projections ?

That's fine if you can quantify the contribution of a company towards global output, but none of your three posts on Antilles tells us much at all.

It would not be helpful to a thread like this to have every copper play mentioned without also mentioning how it affects the global trends imho. Otherwise we bury the thread in announcements that are not even regarded as price sensitive and don't especially contribute to a better understanding of the copper market.

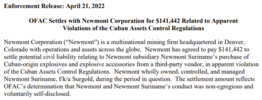

Regarding Antilles and its Cuba arrangement, be aware that the Company is going to need to ensure its financial dealings never run through a SWIFT mechanism or the American government will prosecute them. It's the reason most overseas companies avoid Cuba like the plague, and so will any bank that transacts with Antilles as a result:

View attachment 142651

For example:

View attachment 142648

Copper was just discussed on Ausbiz and the general thought was that Copper producers are a buy at the moment because they've already been beaten downFriday saw London Metal Exchange benchmark copper drop 2.6% to close at $US8,047 a tonne, for its fourth consecutive weekly decline. The metal touched an 18-month low of $US7,955 a tonne in trading.

LME copper was down 4.3% for the week. Comex copper ended at $US3.62 a pound for a loss of more than 3% for the week.

From the all-time high of $US10,700 a tonne (and more than $US5.039 a pound) in March after the Russian invasion of Ukraine, copper slid in May and June dropping below $US8,000 a tonne for the first time in almost 18 months on Friday.

...................................................

Friday saw bad news from Chile for the industry where plans for new, higher taxes on major miners were revealed. By some estimations, the tax on some companies will jump 32%.

The tax means some of the world’s biggest miners will be hit – from state-owned Codelco to BHP, Rio Tinto, Anglo American Glencore and Antofagasta.

A press release from the Chilean treasury said there are two parts to the tax – one is an ad valorem tax between 1% and 2% for companies that produce between 50,000 and 200,000 tonnes of fine copper a year and a rate between 1% and 4% for those that produce more than 200,000 tonnes (BHP is in prime position for the tax – it has Escondida, the world’s biggest mine as well as two other mines in Chile).

The other part of the tax is a rate between 2% and 32% on profits for copper prices between $US2 and $US5 a pound. Both components vary based on the price of copper.

Smaller copper producers will continue with the current tax system.

I’ve watched copper for a few decades, and a bit of a history buff, copper seems to always be one of those metals that promises to make everyone rich but tends to only allow a secret few the success.Copper shares are also being promoted by another "Newsletter writer that has strong links to a broker", who shall remain un-named.

My system's analysis tells me that the price of copper has been falling, and is in a down trend, so why buy copper related shares now? Wait until that trend turns.

KH

Edit: I should declare that I am still short copper futures, otherwise I'll be in trouble.

it was a hard yard to wait ( and average down ) for OZL to come good for me , iron seems to be an easier to understand commodityI’ve watched copper for a few decades, and a bit of a history buff, copper seems to always be one of those metals that promises to make everyone rich but tends to only allow a secret few the success.

It doesn't help us much being the likes of( BHP etc etc ) when Chile puts a 2- 4 % tax on Copper and othersI think once the recession (depression?) we have to have is sorted, copper is going to recover very quickly - Hardly any new major discoveries in some time and the major mines are getting very long of tooth. Might be blood on the streets for a while, but that spells opportunity in this space, IMO.

I won't ask you how well you are doing financially "Buying Low and Selling Higher"yep , i try to buy good companies when they are cheap , even cheaper , and really cheap , and try to sell some when they are getting expensive

Copper price in freefall. Copper miners getting hammered. No sign of a bottom yet as it hits $US3.50/lb.

View attachment 143732

However, copper warehouse stocks continue to decline. The scale of this selloff has surprised me given copper's solid fundamentals. Surely a bottom can't be far away now?

View attachment 143733

i used to be an apprentice glazier , later i worked with a guillotine before modern safety measures and later with rudimentary safety measures ( different job and different guillotine )I won't ask you how well you are doing financially "Buying Low and Selling Higher"

But

I would like to know how many fingers you have left?

and More Importantly

Have you still got 2 Thumbs?

View attachment 143648

am only guessing here , but previously there had been reports of massive copper stockpiles in China and i would guess China is sourcing some copper direct from Russia avoiding the metal exchanges ( and using the $US )Copper price in freefall. Copper miners getting hammered. No sign of a bottom yet as it hits $US3.50/lb.

View attachment 143732

However, copper warehouse stocks continue to decline. The scale of this selloff has surprised me given copper's solid fundamentals. Surely a bottom can't be far away now?

View attachment 143733

Copper price in freefall. Copper miners getting hammered. No sign of a bottom yet as it hits $US3.50/lb.

View attachment 143732

However, copper warehouse stocks continue to decline. The scale of this selloff has surprised me given copper's solid fundamentals. Surely a bottom can't be far away now?

View attachment 143733

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?