- Joined

- 3 November 2013

- Posts

- 1,594

- Reactions

- 2,839

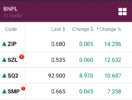

Seemed to me a slight change in sentiment yesterday and today.

Some risk coming back on?

Too many upcoming risks:

- US PPI tonight

- US CPI tomorrow

- BoE ends gilt buy backs on Friday

- US earnings starting on Friday with several companies issuing warnings of earning downgrades

- CCP National congress over the weekend

- Russia ramping up attacks on Ukraine, reportedly targeting energy infrastructure

)

)