- Joined

- 20 December 2021

- Posts

- 218

- Reactions

- 500

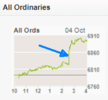

ASX200 is around session highs at midday, putting on track to break resistance around the key 6600 level. All trading carries risk, but it will be interesting to see what the reaction to the RBA decision is in a few hours, and whether it can hold this move into the close.