- Joined

- 21 December 2004

- Posts

- 674

- Reactions

- 1

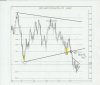

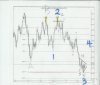

Aussie dollar on the weekly and monthly charts are in a downwards direction re: red arrow pointing downwards. On the daily, it looks like its getting ready to bounce but a very bearish candlestick was formed in the last session. Support lines are still holding but it bounced lost momentum strongly off resistance when it did try to bounce. Next few days will give a better direction as to where it will head short term ie Daily charts.