- Joined

- 21 December 2004

- Posts

- 674

- Reactions

- 1

Re: AUSSIE DOLLAR ... here we go again ?

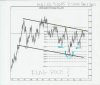

XJO looks like its hitting resistance. Will it break through? The Aussie looks like it will fall which could mean that the XJO will follow. The XJO looks like its hit resistance and appears to be breaking out but too many indicators are saying that it will fail.

Anyway, signal to sell longs activated.

XJO looks like its hitting resistance. Will it break through? The Aussie looks like it will fall which could mean that the XJO will follow. The XJO looks like its hit resistance and appears to be breaking out but too many indicators are saying that it will fail.

Anyway, signal to sell longs activated.