- Joined

- 20 July 2021

- Posts

- 11,169

- Reactions

- 15,492

not so far , the 3 major US indexes are still green , but the trading day isn't over yet .Do we go for another crash round?

not so far , the 3 major US indexes are still green , but the trading day isn't over yet .Do we go for another crash round?

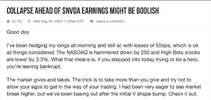

| While even noted Goldman Sachs skeptic Scott Rubner was recently forced to admit that it's hard to be bearish this summer vacation season, it's worth keeping an eye on the Cboe Volatility Index as investors await not only a key Jackson Hole speech from Fed Chair Jerome Powell, but a season-capping earnings report from de facto market bellwether Nvidia. With stocks clinging to slim gains at midday, the VIX is up more than 7%, suggesting that some of us are paper-handing it right into this afternoon's Fed minutes. |

| U.S. stocks today are modestly higher, with the S&P 500 posting a 1-month high, the Dow Jones Industrials posting a 2-1/2 week high, and the Nasdaq-100 posting a 4-week high. Positive corporate news is lifting stocks today, along with M&A activity. The Bureau of Labor Statistics (BLS) revised U.S. payrolls down by -818,000 for the year through March, a bigger decline than expectations of -600,000 and the largest downward revision since 2009. The report was dovish for Fed policy, since it indicated a weaker labor market than was originally reported. The markets are awaiting the minutes of the July 30-31 FOMC meeting later this afternoon for clues on how close the Fed is to cutting interest rates. |

Global liquidity is on the rise. Last week, it slowly climbed $1.13 trillion, pushing the total to an unprecedented $174.67 trillion, marking a new all-time high. This influx of capital into the global financial system indicates an overall increase in access to capital across international markets and an approving nod for risk-on assets, including equities and high-yield bonds. |

With more capital available, global markets could see some momentum in stock markets, especially in sectors sensitive to economic growth, which bodes well for the U.S. and global economies as increased liquidity can fuel economic expansion and boost investor confidence. |

If global liquidity continues to rise, financial markets may strengthen further, with equities likely continuing their upward trajectory. A persistent increase in liquidity would likely lead to lower borrowing costs and stimulate economic activity, but it would also raise concerns about asset bubbles and financial stability. |

i will be watching closely , i have my eye on a China-focused ETF that MIGHT be smashed in a tech-wreck' contagionSo the NVDA results are out:

View attachment 183369

View attachment 183368

View attachment 183370

View attachment 183374View attachment 183373View attachment 183372View attachment 183371

So I'll put in an order at $100. Not sure if it will panic trade that low as stops are hit or even if it continues lower.

I'm sure there will be BTD buyers out there nice and early, but they will get steamrollered more than likely. Let the dust settle first. It's a massively traded stock and there are always bag-holders. The vol. will be high at the open, that's where I may get a random fill as orders will be all over the place.

The SMCI issue could further spook markets and NVDA when it opens. Memories of dot.com.

The only way to get a chance at a fill, at a price that you like, is to sit overnight with an order. I cannot be arsed to get up or sit up to the open, I have a busy day tomorrow. I'll see what it looks like (if not filled) at about 4am NZ time.

jog on

duc

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.