- Joined

- 20 July 2021

- Posts

- 12,077

- Reactions

- 16,806

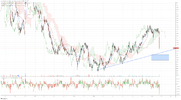

AMP is in the process of an ongoing garage sale ( not that it is unique currently , even in banking/finance , sadly )

one might suggest the brand is so damaged that there is no point chasing the 'goodwill premium ' ( that comes with a full take-over ) , so they are selling what they can

now assuming you price a share ( partly ) on intrinsic value , AMP will most likely still slide simply because of the shrinking assets

one might suggest the brand is so damaged that there is no point chasing the 'goodwill premium ' ( that comes with a full take-over ) , so they are selling what they can

now assuming you price a share ( partly ) on intrinsic value , AMP will most likely still slide simply because of the shrinking assets