- Joined

- 4 December 2008

- Posts

- 486

- Reactions

- 281

Is it possible to modify the display of the weekly charts in Amibroker to show the "week" as the prior five trading days. So, on a Wed the last "week's" bar would be the prior 5 trading days (Wed, Thurs, Fri, Mon, Tue). The last week's bar would show the Wed open, H+L of the prior 5 trading days and the Tue close. All prior weekly bars would have to be adjusted as well.

A little out of the box, but interesting.

Edit: Does anyone know of charting software that can display any timeframe bars, like 3 days data showing as one bar and then for a larger timeframe 8 days data showing as one bar. Can TradingView do this?

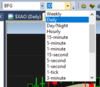

Amibroker can very easily show any timeframe. There is a field beside the stock code that represents the timeframe. D is daily.

It's a dropdown list where you can choose a range of timeframes. But you can also just specify your own even if it's not in the list.

Just type "3D" into the field and you get 3-day timeframe:

However, this isn't exactly what you asked for. When you set the timeframe to 3-day, Amibroker starts counting from the first bar on the chart and groups them accordingly. The example you asked for is a rolling 5-day chart, where the latest bar is made of the last 5 trading days. That means it would have to group them by counting backwards from the current bar. Every day you open the chart it will look different as the open day of the bars shifts every day. Interesting, but I don't know how to do it.