ADI - Adelphi Energy

- Thread starter Dukey

- Start date

-

- Tags

- adelphi energy adi

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

Agentm,

I just sent you a pm. I tried to send you some attachments but I noticed when sending a pm the attachments icon is disabled but one can send attachments when sending a basic reply. Not sure what I'm doing wrong.

its ok, i got the pm.. the pm doesnt allow attachments unfortunately, but i have got email also if you like..

i think the new pioneer wells testing the eagleford are just north of your leases, its interesting that your land is being looked at, and the prices offered are reasonable. is it 36 or 60 month? i am not sure of how far south of the faults the play goes, pioneer has discussed the acreages there and says its eagleford and chalks play are only in some part of their acreages, so i assumed it followed along north of the fault not south of it, but thats not to say it isnt there in your region, i have seen heavy leasing activity in bee county and live oak way south of the fault even by TCEI.

the apache gas unit 1 near you is interesting, very deep and lots of condensate there with that characteristic high gravity that we see around the place.. its saying its WENDLING (WILCOX 11200) and magnum is running the show there, do you know it?

Agentm,

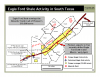

Here is a detailed map of the area with fault lines in black. My families land is located in where I've made a red circle in the middle of the map. The company exploring in the area is Winn Exploration. Lease is for 36 months. What seems a little suspect about the negotiations when inquiring as to why they wanted to lease they(rep. from Winn) stated "our intentions are to set up a well adjacent to landowners next to our land and pull land owners together. But, if they didn't need our land why are they pooling? They are offering also 1/5 royalties. Some additional tid-bit information some blue and white helicopters where hovering around the land about a week ago all day and last Tuesday late at night.

Here is a detailed map of the area with fault lines in black. My families land is located in where I've made a red circle in the middle of the map. The company exploring in the area is Winn Exploration. Lease is for 36 months. What seems a little suspect about the negotiations when inquiring as to why they wanted to lease they(rep. from Winn) stated "our intentions are to set up a well adjacent to landowners next to our land and pull land owners together. But, if they didn't need our land why are they pooling? They are offering also 1/5 royalties. Some additional tid-bit information some blue and white helicopters where hovering around the land about a week ago all day and last Tuesday late at night.

Attachments

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

the region you are in has aa lot of wilcox and warmsley and christmas wells all about 15000.. the pioneer wells are about 17000 feet..

i think winn are keen on the region as the leasing tells me that, and where you are between the faults is obviously prospective .. there has been some horizontal wells drilled from time to time by winn,, so maybe thats why they want to pool?

i will post a map of the region but it looks like the purple fault on your map is the edwards fault that pioneer are tracking across the many counties and extends to polk county and beyond.

i think winn are keen on the region as the leasing tells me that, and where you are between the faults is obviously prospective .. there has been some horizontal wells drilled from time to time by winn,, so maybe thats why they want to pool?

i will post a map of the region but it looks like the purple fault on your map is the edwards fault that pioneer are tracking across the many counties and extends to polk county and beyond.

Attachments

Lol... down 50% yesterday and not a single comment... obviously everyone who has said anything negative about this stock in the past gets shouted down and is now too scared or indifferent to say anything. I think this one is a dud guys... I have lost plenty and I don't think I will ever see that money again...

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

I am/was one of those negative posters, and I maintain my convictions. The drilling is proving far more difficult than originally thought, and its been "about to happen" for years now. And ADI is also in the unfortunate position of being a small party so they are being squeezed by the bigger partners.

- Joined

- 8 October 2006

- Posts

- 230

- Reactions

- 3

Whilst being a very prospective set of leases, that they are paying big money for, the drilling results have been extremely poor so far, and they have had much difficulties with the geology.

Of course imo this is still a speccy share, so I wouldn't invest any money you can't afford to lose. Happy to hear positives and negatives!

Of course imo this is still a speccy share, so I wouldn't invest any money you can't afford to lose. Happy to hear positives and negatives!

I am/was one of those negative posters, and I maintain my convictions. The drilling is proving far more difficult than originally thought, and its been "about to happen" for years now. And ADI is also in the unfortunate position of being a small party so they are being squeezed by the bigger partners.

I am pretty sure the credit crisis hasn't helped much either. There are many companies in need of cash at the moment. ADI certainly isn't an orphan in things going slow and then money drying up. I would also imagine that the current oil price isn't helping small oil and gas companies worldwide. If things go right at least the drilling costs may be cheaper.

- Joined

- 1 June 2008

- Posts

- 159

- Reactions

- 0

Aren't we just seeing 6c because of the share issue? Doesn't that make sense to other people?

I expected to see 6c, people want to flog off what they've got and can replace at a later date.

I'm not happy that TCEI seem to be stuffing another hole up though. I can't imagine why they haven't learnt.

I've thought for some time that they're trying to screw the little aussie companies, and that's becomming true - they're using our money to figure out how to drill.

I reckon we'll sell Yemen and whoever picks it up will be sitting on a goldmine 5 years down the track.

I expected to see 6c, people want to flog off what they've got and can replace at a later date.

I'm not happy that TCEI seem to be stuffing another hole up though. I can't imagine why they haven't learnt.

I've thought for some time that they're trying to screw the little aussie companies, and that's becomming true - they're using our money to figure out how to drill.

I reckon we'll sell Yemen and whoever picks it up will be sitting on a goldmine 5 years down the track.

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

Lol... down 50% yesterday and not a single comment... obviously everyone who has said anything negative about this stock in the past gets shouted down and is now too scared or indifferent to say anything. I think this one is a dud guys... I have lost plenty and I don't think I will ever see that money again...

dink, i think the sp was always going to meet the ssp price.. if its a dud on based on the sp following the trend all stocks follow in this circumstance, which is your view, then so be it, nice to hear it and i have no problem with your view, other than i dont agree with it. but not shouting you down, the shouting down has come in the past from people negative on the stock in a directly personal way towards anyone who discussed the operation ADi and the jvp undertook..

the only comment i have on the massive exit that occurred, is its very odd that people on HC knew of the drill string issue prior to the announcement, and obviously there were other who also knew.. from no trades at all to a massive exit in one moment.. very odd.. but well done to the buyer who is obviously not seeing the same picture you paint dink.. i think you would agree that we all wish the investor the best and all want investors to do well?

I am/was one of those negative posters, and I maintain my convictions. The drilling is proving far more difficult than originally thought, and its been "about to happen" for years now. And ADI is also in the unfortunate position of being a small party so they are being squeezed by the bigger partners.

prawn, the delays in the beginning were always explained, leasing 350,000 acres of land is no small undertaking, the first well was drilling for the hosston sands at 21000 feet, when the chalks were as active in our well as it was 6 miles west, it would have been irresponsible to disregard the discovery and not act on it, so the jvp did act on the discovery and lease acreages.. your simplistic view that the events always seem to reflect the "about to happen" scenario is somewhat tiresome, every holder is aware of the delays, and the biggest hurdle, the ability to successfully frac a well at 12000 feet down and up to a mile horizontal against this massively overpressurised and extremely hot formation, has finally been solved by the conocophillips operations in kunde 3. which replicates the staggering results of the vertical frac in kunde 1 discovery well. so no more expensive underbalanced drilling is needed.. there are options now to make wells cheaper and less complicated and get similar results. things are moving forward prawn, your just dont seem to acknowledge it..

i know you dont get it, but these rocks can be fracced and produce of the fracture stimulation, no other tight chalk rock has been able to do this in texas. the economics are practically there.. it didnt take 14 years like it did in the barnett shale, this has taken about 4- 5 years

as for them being squeezed out by bigger parties? thats exactly what they are planning on!! bring it on i say!!

Whilst being a very prospective set of leases, that they are paying big money for, the drilling results have been extremely poor so far, and they have had much difficulties with the geology.

Of course imo this is still a speccy share, so I wouldn't invest any money you can't afford to lose. Happy to hear positives and negatives!

agreed

I am pretty sure the credit crisis hasn't helped much either. There are many companies in need of cash at the moment. ADI certainly isn't an orphan in things going slow and then money drying up. I would also imagine that the current oil price isn't helping small oil and gas companies worldwide. If things go right at least the drilling costs may be cheaper.

correct.. drilling costs are already 40% lower, and the thought of now moving away from underbalanced to fast wells with fracture stimulation is going to be very attractive to the jvp imho

my view is that while oil is low and the $US remains the safe haven currency it miraculously is today, then the economics is still a tough out of reach, but well costs have come back 40% which is about what the AUS$ has devalued against the greenback, and imho the modeling done on this must be looking better when/if oil may makes its recovery, and who know how long the $US will be the safest place to put your cash.

tough to see the sp fall away but imho totally expected in light of the cap raising price..

I don't like hearing your 'negative views' prawn, but your right. Been going for years now and still just around the corner. No offence to Agent M and his info but........

I posted a while back, that the yanks could delay results, as to hurt the little jvp's, and this still seems likely.

Not being racist, but I don't trust Americans.

This is more evident today than anytime before. Don't trust Americans when money is involved.

This one is starting to hurt, and yet I'm contemplating throwing in another $5k.

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

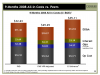

from pioneers recent presentation

http://library.corporate-ir.net/lib...E0DF3B32D8_PXD_CreditSuisseEnergyConf2509.pdf

Well costs

– Continuing to work with service companies to reduce drilling and completion

costs (using only PXD equipment where possible)

• Achieved 15% - 20% reduction in costs by year-end ’08

• Targeting an additional 10% - 20% reduction

Will increase drilling activity when we have confidence in sustained

commodity prices above $60 oil / $6 gas, coupled with additional well cost

reductions from current levels

Decreased Drilling Activity

– 29 rigs to 9 rigs during Q4

– 3 rigs by mid-February

sounds familair.. there will be not a great deal of drilling on a lot of onshore unconventional and a great deal of offshore fields whist the oil remains where it is. imho it cannot last. with oil rigs stacked up all over texas and companies scaling back dramatically, surely there will be a day of reckoning.

http://library.corporate-ir.net/lib...E0DF3B32D8_PXD_CreditSuisseEnergyConf2509.pdf

Well costs

– Continuing to work with service companies to reduce drilling and completion

costs (using only PXD equipment where possible)

• Achieved 15% - 20% reduction in costs by year-end ’08

• Targeting an additional 10% - 20% reduction

Will increase drilling activity when we have confidence in sustained

commodity prices above $60 oil / $6 gas, coupled with additional well cost

reductions from current levels

Decreased Drilling Activity

– 29 rigs to 9 rigs during Q4

– 3 rigs by mid-February

sounds familair.. there will be not a great deal of drilling on a lot of onshore unconventional and a great deal of offshore fields whist the oil remains where it is. imho it cannot last. with oil rigs stacked up all over texas and companies scaling back dramatically, surely there will be a day of reckoning.

Attachments

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

estseon

1/ kowalik would either face an acid wash/frac or they can cement the entire well casing and frac the entire well.

2/the fishing out of the drill string is expensive and complex but not out the reach of technology available today. its done a lot and its a standard operation generally, there are crews extremely experienced in this type of operation. my concern is the well costs right now there.

this from saf..

Safiande - 6 Feb'09 - 10:09 - 50258 of 50307

Pioneer expecting “ tremendous results “ from Eagle Ford well 3000ft lateral.

Well drilled in DeWitt next to Karnes. Expected to be fracced in late March / early Apr.

Pioneer 4th qtr earnings 4 Feb 2009 Transcript

Scott D. Sheffield - Chairman and Chief Executive Officer

“In addition in the same area, and where we feel like as a sweet spot, very comparable to Petrohawk's recent two discoveries. In regard to the Eagle Ford Shale we completed our 3,000 foot lateral. We did call it, we're analyzing it and we will frac that well next month in March, expecting tremendous results from this well in the Eagle Ford Shale play.”

“The Eagle Ford Shale, of course is shown on slide 18, is an important growth area, in a sense that we have about 310,000 acres under lease, it just happens to coincide with the Edwards Trend acreage as shown on yellow on slide 18. We even have acreage, it's very close to juxtapose to the Petrohawk recent discoveries. In fact, in a couple of cases we've got 15,000 acres juxtaposed about a mile away from the more Southwest of the Petrohawk wells. And, we've got about 6,000 gross acres about 8 miles away from where the next completion is expected. So we'll probably be pursuing some drilling in these areas looking ahead.

Notwithstanding that we would believe, that our acreage in general will have equal prospectivity to some of the results you're seeing with Petrohawk, and we'll be pursuing that looking ahead. And we have as Scott has already mentioned, one well, we drill a 3,000 foot lateral along. But right in the midst right now, as we're evaluating the core and these objective being properly design the frac for this well which is anticipated at the end of March or into early April. But this is something looking ahead that has substantial resource potential, and we think can really grow our South Texas operations.”

“Brian Singer - Goldman Sachs

Wanted to check in on backlog on both the oil and the gas side if you look to lower 48 onshore, how much production do you have behind pipe or are waiting completion?

Scott Sheffield

Yes, I'm surprised by the comments that I have seen a lot of people are doing that. Most leases in the U.S., most royalty owners do not allow you to unless it's on a held by production lease. So we have zero, very little and so the articles that I have seen in new releases you can not drill a well and leave it shut in, you'll loose your lease. And so its got be on held by production leases that people are doing at. So I don't understand the companies that are doing that you really have to ask them.

Brian Singer - Goldman Sachs

Okay. And I guess the flipside is when you do start drilling again if commodity prices improve would you expect an immediate production ramp or is there some delay that one should expect?

Scott Sheffield

It will be a lag period of about at least three months. Obviously, in South Texas with the top of the wells that we make 8 million to 10 million a day, you'll see a big ramp up there. In Spraberry, it will be a slower ramp because the type of well. Raton will be a slower ramp so it varies by area.

Brian Singer - Goldman Sachs

Okay. And then lastly, on the Pierre, Eagle Ford and Edwards, what gas price would you need to see to get more aggressive in drilling is that the $6 or there different numbers for those three basins?

Scott Sheffield

I'm going to say $6 with the appropriate well cost that we see are coming done. We will definitely get more aggressive”

http://seekingalpha.com/article/118...urces-q4-2008-earnings-call-transcript?page=2

1/ kowalik would either face an acid wash/frac or they can cement the entire well casing and frac the entire well.

2/the fishing out of the drill string is expensive and complex but not out the reach of technology available today. its done a lot and its a standard operation generally, there are crews extremely experienced in this type of operation. my concern is the well costs right now there.

this from saf..

Safiande - 6 Feb'09 - 10:09 - 50258 of 50307

Pioneer expecting “ tremendous results “ from Eagle Ford well 3000ft lateral.

Well drilled in DeWitt next to Karnes. Expected to be fracced in late March / early Apr.

Pioneer 4th qtr earnings 4 Feb 2009 Transcript

Scott D. Sheffield - Chairman and Chief Executive Officer

“In addition in the same area, and where we feel like as a sweet spot, very comparable to Petrohawk's recent two discoveries. In regard to the Eagle Ford Shale we completed our 3,000 foot lateral. We did call it, we're analyzing it and we will frac that well next month in March, expecting tremendous results from this well in the Eagle Ford Shale play.”

“The Eagle Ford Shale, of course is shown on slide 18, is an important growth area, in a sense that we have about 310,000 acres under lease, it just happens to coincide with the Edwards Trend acreage as shown on yellow on slide 18. We even have acreage, it's very close to juxtapose to the Petrohawk recent discoveries. In fact, in a couple of cases we've got 15,000 acres juxtaposed about a mile away from the more Southwest of the Petrohawk wells. And, we've got about 6,000 gross acres about 8 miles away from where the next completion is expected. So we'll probably be pursuing some drilling in these areas looking ahead.

Notwithstanding that we would believe, that our acreage in general will have equal prospectivity to some of the results you're seeing with Petrohawk, and we'll be pursuing that looking ahead. And we have as Scott has already mentioned, one well, we drill a 3,000 foot lateral along. But right in the midst right now, as we're evaluating the core and these objective being properly design the frac for this well which is anticipated at the end of March or into early April. But this is something looking ahead that has substantial resource potential, and we think can really grow our South Texas operations.”

“Brian Singer - Goldman Sachs

Wanted to check in on backlog on both the oil and the gas side if you look to lower 48 onshore, how much production do you have behind pipe or are waiting completion?

Scott Sheffield

Yes, I'm surprised by the comments that I have seen a lot of people are doing that. Most leases in the U.S., most royalty owners do not allow you to unless it's on a held by production lease. So we have zero, very little and so the articles that I have seen in new releases you can not drill a well and leave it shut in, you'll loose your lease. And so its got be on held by production leases that people are doing at. So I don't understand the companies that are doing that you really have to ask them.

Brian Singer - Goldman Sachs

Okay. And I guess the flipside is when you do start drilling again if commodity prices improve would you expect an immediate production ramp or is there some delay that one should expect?

Scott Sheffield

It will be a lag period of about at least three months. Obviously, in South Texas with the top of the wells that we make 8 million to 10 million a day, you'll see a big ramp up there. In Spraberry, it will be a slower ramp because the type of well. Raton will be a slower ramp so it varies by area.

Brian Singer - Goldman Sachs

Okay. And then lastly, on the Pierre, Eagle Ford and Edwards, what gas price would you need to see to get more aggressive in drilling is that the $6 or there different numbers for those three basins?

Scott Sheffield

I'm going to say $6 with the appropriate well cost that we see are coming done. We will definitely get more aggressive”

http://seekingalpha.com/article/118...urces-q4-2008-earnings-call-transcript?page=2

Attachments

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

further research from saf

not sure on the answers estseon, as tcei is a partner with conoco on those wells, and tcei would view the entire play they have leased as a major project, i think most investors only have the narrow view on the 23,000 acres we are jvp in and not understand that the tcei/conoco operations are part and parcel of the big picture. anything TCEI learns will be utilised in the development of our acraeges.

saf again has been researching well, this is well worth looking into..

Safiande - 9 Feb'09 - 12:08 - 50327 of 50347

More encouraging noises on Eagleford, this time from Anadarko (APC)

Anadarko Petroleum Corporation Q4 2008 Earnings Call Transcript Feb 3 , 2009

“John [Wagazino] - Wachovia

Same thing on the Eagleford, I’m curious if you’d just give a little bit more color on expected IP, well costs, that kind of thing.

Robert P. Daniels

On Eagleford, the Maverick [pason] we’re in a deal with TXEO right now where they’re operating the wells. It’s a drilled earn type of thing and they’re in Phase 2 of that program. We like what we’re seeing down there but we’re really early in that one. It’s got a lot of work to do both on what the costs are going to ultimately get down to and what the rates are going to be. We haven’t gotten off a full frac yet on any of our horizontals that we think would be like a production stage frac but we do see very good encouragement in gas and actually liquid rates coming out of there and we’re going to be spending more money in the maverick to try to learn what we need to learn to see how economic it’s going to be but so far so good down there.”

“Raymond Deacon - Pritchard Capital

I guess just curious as far as your deepwater needs, you talked about needing price concessions. Is there... I guess how many rigs do you see yourself looking into? My impression was you had a lot of long term contracts and so there wouldn’t be much ability to cut your costs in ’09.

Karl F. Kurz

Right now we’re excited about our program. As we mentioned during the call, everything we are doing in ’09 we think is value accretive. We’ve looked at everything. We’re moving some stuff around to make sure we drill the core areas on our portfolio both onshore and offshore is very competitive. We have new projects like the Marcellus and Haynesville and Maverick. They’re competing aggressively for capital. Very excited. Our desire is to widen our margins and make these projects even more competitive and more value accretive by getting costs down. I don’t want to leave you under the impression that we have to get our costs down to make our projects work. As Jim mentioned in our big projects work at current cost with $30 oil. So we’re working the cost side just to create more value but not to make our projects economical”

http://seekingalpha.com/article/118...8-earnings-call-transcript?source=bnet&page=7

http://library.corporate-ir.net/lib...01F0-4B70-8DEB-46DBCE52BB01_APC_2.3.09_v2.pdf

APC partner is TXCO. From their web site:-

http://www.txco.com/operationscube.html

Safiande - 9 Feb'09 - 14:10 - 50329 of 50347

Interesting comment about ConocoPhilips moving into Eagle Ford & the associated number of rigs from Meridian in their conference call transcript on cost cutting measures released as a 8k SEC filing to AMEX today on their site i.e. COP originally planned a 10 rig Eagle Ford programme (Cote Dór)in 2009 which indicates the prospectivity of the formation, but which now might be reduced to 6 rigs because of the economic crisis etc. COP ´s CAPEX for 2009 is due to be issued on 11 Mar 2009.

"Gary Dohner - Financial Management International - Analyst

Okay. You also made mention in that same announcement about relevant acreage positions in South Central that is on the trend with the new Eagle Ford shale discoveries. What is the size, the potential of the field, drilling depths and cost, and how important is this play and when do you plan to begin exploration and development? And if partners are not found to defray the cost, is it possible to fund the initial exploration well ourselves given the new budget?

Also, what is the status with the Archtop play and possible partners as I believe the lease is coming up for renewal and the cost of

drilling, as well as the technical expertise required, are rather substantial in both

Paul Ching - Meridian Resource - Chairman & interim CEO

On the Eagle Ford shale, we are in a position that we have -- what is it 12,000 --? (multiple speakers) 30,000-some acres if I remember right, 30,000 acres on trend with the Petrohawk well. Petrohawk has made a well in Eagle Ford. They came on. I don't remember the numbers -- and what we're doing is we're watching. We are not going to go out and drill the well. We're going to see what they do. We're going to see whether they start to develop the area around there if they drill some more wells, and we are also going to see what the production curve of that particular well or any other wells they drill is to see what the type curve is. So if it comes in real high rate, 12 months later what is this, we can get an idea what the type curve is so we can get an idea what we might have on our lease.

Gary Dohner - Financial Management International - Analyst

So you are going to let them do the experimentation and the exploration and then learn from that to conserve the capital in the interim and not necessarily look for partners to defray the cost and jump in at this time?

Paul Ching - Meridian Resource - Chairman & interim CEO

We are looking for partners. We're looking for partners out there with this acreage, and most of the partners have somewhat of the same idea. They are kind of waiting to see what happens with the Petrohawk discovery and what Petrohawk does.

Also, remind me guys, Conoco Philips? Conoco Philips has acreage, and Conoco Philips had said they were going to move in, and they were going to have a 10 rig program is what we heard, and now we are hearing that it is a six rig program, and that may even be optimistic. So there is plenty of activity going on around us, and what I want to do is learn."

http://b2i.api.edgar-online.com/EFX...ConvPDF1?SessionID=LuDIWSxXa9tANR9&ID=6389031

http://www.b2i.us/profiles/investor/secxml.asp?f=1&BzID=1440&to=sc&Nav=0&LangID=1&s=0

not sure on the answers estseon, as tcei is a partner with conoco on those wells, and tcei would view the entire play they have leased as a major project, i think most investors only have the narrow view on the 23,000 acres we are jvp in and not understand that the tcei/conoco operations are part and parcel of the big picture. anything TCEI learns will be utilised in the development of our acraeges.

saf again has been researching well, this is well worth looking into..

Safiande - 9 Feb'09 - 12:08 - 50327 of 50347

More encouraging noises on Eagleford, this time from Anadarko (APC)

Anadarko Petroleum Corporation Q4 2008 Earnings Call Transcript Feb 3 , 2009

“John [Wagazino] - Wachovia

Same thing on the Eagleford, I’m curious if you’d just give a little bit more color on expected IP, well costs, that kind of thing.

Robert P. Daniels

On Eagleford, the Maverick [pason] we’re in a deal with TXEO right now where they’re operating the wells. It’s a drilled earn type of thing and they’re in Phase 2 of that program. We like what we’re seeing down there but we’re really early in that one. It’s got a lot of work to do both on what the costs are going to ultimately get down to and what the rates are going to be. We haven’t gotten off a full frac yet on any of our horizontals that we think would be like a production stage frac but we do see very good encouragement in gas and actually liquid rates coming out of there and we’re going to be spending more money in the maverick to try to learn what we need to learn to see how economic it’s going to be but so far so good down there.”

“Raymond Deacon - Pritchard Capital

I guess just curious as far as your deepwater needs, you talked about needing price concessions. Is there... I guess how many rigs do you see yourself looking into? My impression was you had a lot of long term contracts and so there wouldn’t be much ability to cut your costs in ’09.

Karl F. Kurz

Right now we’re excited about our program. As we mentioned during the call, everything we are doing in ’09 we think is value accretive. We’ve looked at everything. We’re moving some stuff around to make sure we drill the core areas on our portfolio both onshore and offshore is very competitive. We have new projects like the Marcellus and Haynesville and Maverick. They’re competing aggressively for capital. Very excited. Our desire is to widen our margins and make these projects even more competitive and more value accretive by getting costs down. I don’t want to leave you under the impression that we have to get our costs down to make our projects work. As Jim mentioned in our big projects work at current cost with $30 oil. So we’re working the cost side just to create more value but not to make our projects economical”

http://seekingalpha.com/article/118...8-earnings-call-transcript?source=bnet&page=7

http://library.corporate-ir.net/lib...01F0-4B70-8DEB-46DBCE52BB01_APC_2.3.09_v2.pdf

APC partner is TXCO. From their web site:-

http://www.txco.com/operationscube.html

Safiande - 9 Feb'09 - 14:10 - 50329 of 50347

Interesting comment about ConocoPhilips moving into Eagle Ford & the associated number of rigs from Meridian in their conference call transcript on cost cutting measures released as a 8k SEC filing to AMEX today on their site i.e. COP originally planned a 10 rig Eagle Ford programme (Cote Dór)in 2009 which indicates the prospectivity of the formation, but which now might be reduced to 6 rigs because of the economic crisis etc. COP ´s CAPEX for 2009 is due to be issued on 11 Mar 2009.

"Gary Dohner - Financial Management International - Analyst

Okay. You also made mention in that same announcement about relevant acreage positions in South Central that is on the trend with the new Eagle Ford shale discoveries. What is the size, the potential of the field, drilling depths and cost, and how important is this play and when do you plan to begin exploration and development? And if partners are not found to defray the cost, is it possible to fund the initial exploration well ourselves given the new budget?

Also, what is the status with the Archtop play and possible partners as I believe the lease is coming up for renewal and the cost of

drilling, as well as the technical expertise required, are rather substantial in both

Paul Ching - Meridian Resource - Chairman & interim CEO

On the Eagle Ford shale, we are in a position that we have -- what is it 12,000 --? (multiple speakers) 30,000-some acres if I remember right, 30,000 acres on trend with the Petrohawk well. Petrohawk has made a well in Eagle Ford. They came on. I don't remember the numbers -- and what we're doing is we're watching. We are not going to go out and drill the well. We're going to see what they do. We're going to see whether they start to develop the area around there if they drill some more wells, and we are also going to see what the production curve of that particular well or any other wells they drill is to see what the type curve is. So if it comes in real high rate, 12 months later what is this, we can get an idea what the type curve is so we can get an idea what we might have on our lease.

Gary Dohner - Financial Management International - Analyst

So you are going to let them do the experimentation and the exploration and then learn from that to conserve the capital in the interim and not necessarily look for partners to defray the cost and jump in at this time?

Paul Ching - Meridian Resource - Chairman & interim CEO

We are looking for partners. We're looking for partners out there with this acreage, and most of the partners have somewhat of the same idea. They are kind of waiting to see what happens with the Petrohawk discovery and what Petrohawk does.

Also, remind me guys, Conoco Philips? Conoco Philips has acreage, and Conoco Philips had said they were going to move in, and they were going to have a 10 rig program is what we heard, and now we are hearing that it is a six rig program, and that may even be optimistic. So there is plenty of activity going on around us, and what I want to do is learn."

http://b2i.api.edgar-online.com/EFX...ConvPDF1?SessionID=LuDIWSxXa9tANR9&ID=6389031

http://www.b2i.us/profiles/investor/secxml.asp?f=1&BzID=1440&to=sc&Nav=0&LangID=1&s=0

Attachments

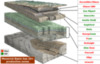

Here's some interesting readings

Pgs': 1, 7, 9, 26, & 40

http://www.searchanddiscovery.net/documents/2008/08100harris43/images/harris43.pdf

and:

http://www.energyindustryphotos.com/eagle_ford_shale__formation_of_s.htm

Pgs': 1, 7, 9, 26, & 40

http://www.searchanddiscovery.net/documents/2008/08100harris43/images/harris43.pdf

and:

http://www.energyindustryphotos.com/eagle_ford_shale__formation_of_s.htm

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

jestex..

i really liked the edwards study, i think its worth a read myself.

the 2 conoco wells continue to be drilled side by side in live oak

hope you do well drubula, all LT holders i think are well and truly over the time things have taken. i hope we can see some sort of turnaround soon.

i really liked the edwards study, i think its worth a read myself.

the 2 conoco wells continue to be drilled side by side in live oak

hope you do well drubula, all LT holders i think are well and truly over the time things have taken. i hope we can see some sort of turnaround soon.

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

i recommend anyone with long term views on the project listen to the feb 17 presentation by txco

http://www.txco.com/presentation.html

anadarko is doing a jvp farm in with them, and runs the show on their recent eagleford well, they put in a 10 stage frac on that well and will not disclose their results. (reminds me of conoco and the kunde 3 well!)

they did get some results from 5 stage fracs in the eagleford open hole, they were all short completions, 2500 feet.. but i get the impression this last well was designed differently in their engineering of the frac, with a 10 stage multifrac, but i got the impression they did the last well with a cemented liner.

all operators including petrohawk have had their problems with the overpressurised shale, and all operators say they are finding better solutions after each completion.

you have to keep in account that TCEI is headed up by mr fluor, he sits on the board of anadarko, they have extensive exposure to the eagleford shale and chalks play that trends throughout this very active region across texas

TCEI is also in a jvp with conocophillips who are equally interested in this play.. both anadarko and conocophillips are the type of players that can take on a project this size, and both are doing extensive work on these eagleford and chalks regions..

time to track down and study this last completion of TXCO/anadarko well..

http://www.txco.com/presentation.html

anadarko is doing a jvp farm in with them, and runs the show on their recent eagleford well, they put in a 10 stage frac on that well and will not disclose their results. (reminds me of conoco and the kunde 3 well!)

they did get some results from 5 stage fracs in the eagleford open hole, they were all short completions, 2500 feet.. but i get the impression this last well was designed differently in their engineering of the frac, with a 10 stage multifrac, but i got the impression they did the last well with a cemented liner.

all operators including petrohawk have had their problems with the overpressurised shale, and all operators say they are finding better solutions after each completion.

you have to keep in account that TCEI is headed up by mr fluor, he sits on the board of anadarko, they have extensive exposure to the eagleford shale and chalks play that trends throughout this very active region across texas

TCEI is also in a jvp with conocophillips who are equally interested in this play.. both anadarko and conocophillips are the type of players that can take on a project this size, and both are doing extensive work on these eagleford and chalks regions..

time to track down and study this last completion of TXCO/anadarko well..

Attachments

Agentm,

Nice post. I'm pretty sure you've seen Weber Energy's information on there on going exploration in South Texas.

The 7th slide is the one that grab's my attention.

http://weberenergy.com/TxOilGas/Tx-Oil-Gas-3.html

Nice post. I'm pretty sure you've seen Weber Energy's information on there on going exploration in South Texas.

The 7th slide is the one that grab's my attention.

http://weberenergy.com/TxOilGas/Tx-Oil-Gas-3.html