nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

A-REIT Sector: Weekending Friday 06 July 2018

This week an amazing rebound in the All-Ords and the A-REIT Sector. No tax breaks for big business; declaration of a global trade war; our dollar drifting lower; banks under the spotlight for the increasing number of mortgages under pressure and the number of dubious business loans to small businesses, housing prices falling, no real wage growth, and the loss of week-end penalty rates going to curtail retail spending and impair even more mortgages. The list goes on. What am I missing that would make our markets surge? Good luck. .

.

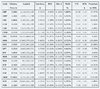

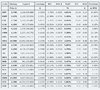

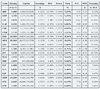

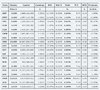

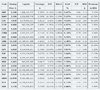

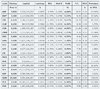

The A-REIT Table for closing prices for Weekending Friday 06 July 2018 follows:

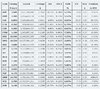

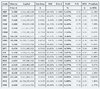

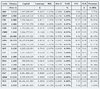

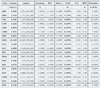

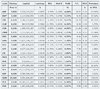

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the ASX 200 XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 22 June 2018, can change from day to day due to active share buy-back programs and other factors.

3. The "Capital", "Earnings", "Distribution" and "NTA" figures have also been updated as at 22 June 2018. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

5. The tables have been updated to include Charter Hall Long Wale, Viva Energy REIT and the change from Westfields to Unibail Rodamco Westfield.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck .

.

This week an amazing rebound in the All-Ords and the A-REIT Sector. No tax breaks for big business; declaration of a global trade war; our dollar drifting lower; banks under the spotlight for the increasing number of mortgages under pressure and the number of dubious business loans to small businesses, housing prices falling, no real wage growth, and the loss of week-end penalty rates going to curtail retail spending and impair even more mortgages. The list goes on. What am I missing that would make our markets surge? Good luck.

The A-REIT Table for closing prices for Weekending Friday 06 July 2018 follows:

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the ASX 200 XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 22 June 2018, can change from day to day due to active share buy-back programs and other factors.

3. The "Capital", "Earnings", "Distribution" and "NTA" figures have also been updated as at 22 June 2018. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

5. The tables have been updated to include Charter Hall Long Wale, Viva Energy REIT and the change from Westfields to Unibail Rodamco Westfield.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck