nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

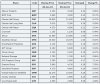

Been noticing this too. I wonder if it's about defensive positioning in markets.

In Australia, I wonder if some people are selling down banks and re-balancing to property trusts. With stalling real estate prices, the rental yields would look more attractive. Additionally, if you follow the Coalition rhetoric, Fed Labor's policies will drive rents even higher.

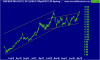

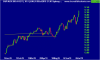

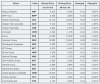

But a sensational last quarter, and looking like a technical break out

The suggestion is that, investors are bypassing property for now and investing in the share market. DXS is trading at newish highs as well as CHC and GPT. CHC is rumored to be running a ruler over the AMP property portfolio.