nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

A-REIT Sector: Weekending Friday 15 December 2017

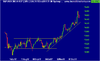

Last weeks resistance level got smacked out the door as the A-REIT Sector rallied on Tuesday on the news of a big bid for the Westfield Group. Westfield's finished the week up 10% with CHC, GMG, SCG and VCX also beating the rest of the sector for a change. Although the surge ran out of steam on Thursday and Friday the gains out weighed the losses with the volumes suggesting that there is still plenty of interest in the sector. There will likely be some selling toward the end of this week as International holders lock in profits before their shares go Ex-Div and then pick them up again at the Ex-Div prices in the first few days of January 2018. Good luck. .

.

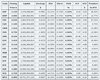

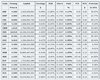

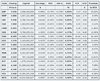

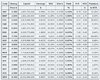

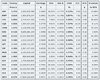

The A-REIT Table for closing prices for Weekending Friday 15 December 2017 follows:

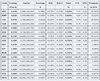

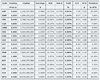

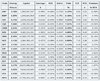

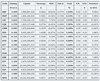

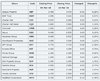

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 13 October 2017, can change from day to day due to active share buy-back programs and other factors.

3. The "Earnings", "Distribution" and "NTA" figures have also been updated as at 13 October 2017. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck .

.

Last weeks resistance level got smacked out the door as the A-REIT Sector rallied on Tuesday on the news of a big bid for the Westfield Group. Westfield's finished the week up 10% with CHC, GMG, SCG and VCX also beating the rest of the sector for a change. Although the surge ran out of steam on Thursday and Friday the gains out weighed the losses with the volumes suggesting that there is still plenty of interest in the sector. There will likely be some selling toward the end of this week as International holders lock in profits before their shares go Ex-Div and then pick them up again at the Ex-Div prices in the first few days of January 2018. Good luck.

The A-REIT Table for closing prices for Weekending Friday 15 December 2017 follows:

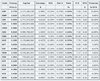

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 13 October 2017, can change from day to day due to active share buy-back programs and other factors.

3. The "Earnings", "Distribution" and "NTA" figures have also been updated as at 13 October 2017. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck